- Summary:

- The Kadena Price has dropped 60% in the last four weeks, but downside pressure continues to weigh heavily on the KDA token.

The Kadena Price has dropped 60% in the last four weeks, but downside pressure continues to weigh heavily on the KDA token.

Kadena (KDA) was one of several coins that exploded higher in Q3. After spending most of the summer trading for cents on the dollar, the KDA token surged 3,500% between September and early November. However, after reaching an all-time high of $28.58 on November 11th, KDA has been in freefall. Subsequently, Kadena’s market cap has dropped from $4.3 billion to around $1.7b, ranking KDA the 71st most-valuable Cryptocurrency, behind Basic Attention Token.

The cryptocurrency market is struggling to regain the momentum that lifted the asset class to a $3 trillion market cap in November. Bitcoin’s $20,000 decline from $69,000 has forced altcoin investors to question the formerly lofty valuations, resulting in sustained profit-taking. As a result, the Kadena price should continue lower, which may present an opportunity to accumulate at a fair price.

KDA Price Forecast

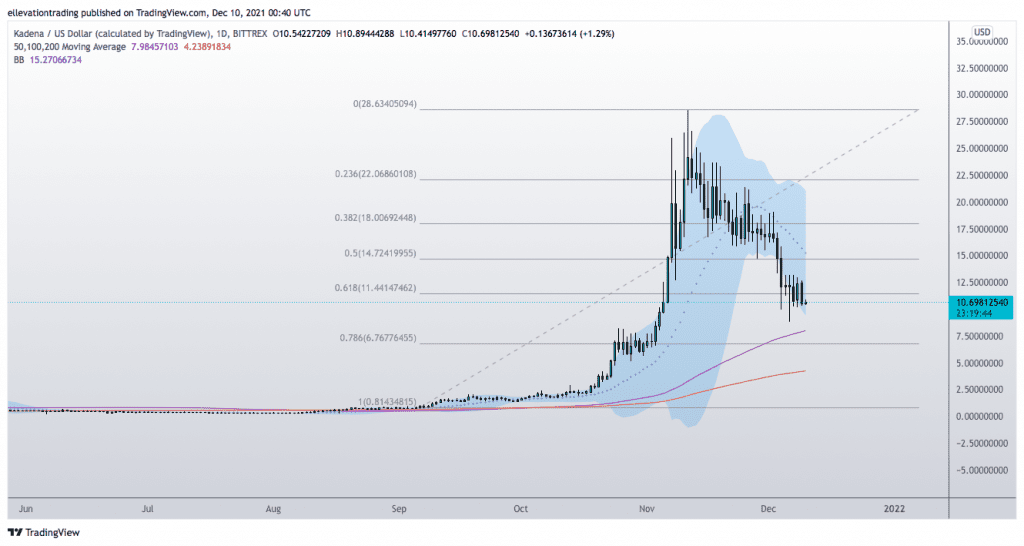

The daily chart shows Kadena is consolidating around the 0.618 Fibonacci retracement level of $11.44. However, the token is close to breaking down and looks likely to test the 100-Day Moving Average at $7.98.

Above the market, $13.20 (December 5/6/7 highs) is the first resistance, followed by $18.00 (November 28th low and 50% Fibo retracement).

In my opinion, as long as the price remains below $13.00, the outlook is negative. On that basis, my initial price target is $8.00. However, a close above $13.00 invalidates the bearish view.

Kadena Price Chart (Daily)

For more market insights, follow Elliott on Twitter.