More and more people are talking about the end of the dollar, especially at a time when the currency is weakening in the markets. The hesitation of the monetary authorities in the face of an inflation rate that is difficult to predict makes it more complicated to diagnose the future of the mother currency.

At the moment, the debate is centred on whether the Federal Reserve will stop the monetary pressure, given the fear of an economic recession in the United States, as well as a collapse in the equity markets, or whether it will continue to bet on rate hikes, as some members of the Federal Reserve have advocated.

Subdued inflation data seems to make a rate hike unnecessary, which would keep the dollar strong against other currencies. On the other hand, the response of the labour market, which remains at a relatively low unemployment rate, has been an extremely positive scenario for the US economy.

The Yuan is conquering markets.

On the international scene, movements are also taking place that suggest an end to the dollar’s dominance is on the horizon. The conflict in Ukraine has polarised the positions of the main economic blocs.

China is using its portfolio of trading partners to redistribute Russia’s raw material surpluses, in exchange, of course, for trade in yuan. This lays the foundations for an internationalisation of its currency, encouraging the presence of yuan reserves in the central banks of America, Africa, and Asia.

It seems that the dollar’s stronghold in the future will only be the Western European market.

But has the dollar’s story really ended here?

The charts could be pointing to a very different outcome. It is not out of the question that the dollar index could resume a strong upward move towards 120 points. And given that the Fed seems to have no intention of continuing to tighten monetary policy, on the contrary even increasing the balance sheet with new liquidity windows, it is likely that such a rise in the dollar will be triggered by increased uncertainty in global markets.

The US is still the world’s leading economy, and when things get bad, capital takes refuge in the dollar and US bonds.

DXY Dollar Index in possible support zone.

What is happening in the gold market?

On the other hand, the gold market, the dollar’s surrogate, seems to have peaked at around two thousand dollars per ounce.

This means that a bearish rebound would coincide perfectly with a dollar rally.

Gold market at all-time highs.

What about Europe?

Finally, the second-largest currency in the world, the euro, would weaken against the dollar, initiating a downward movement in line with the rest of the charts explained.

Moreover, from a fundamental perspective, the conflict in Ukraine has severely damaged Europe’s energy resources. Its industrial activity, as well as the costs of transporting supplies, have suffered as a result. Despite widespread optimism, Europe’s energy problem has not yet been solved.

Substitute sources of Russian gas are significantly more expensive, and this will inevitably affect Europe’s productivity and economic growth. When the unemployment rate starts to make Europe’s difficulties evident, social concerns will push for internal debates on budget adjustments, as we have seen years ago, thus launching a new wave of euroscepticism.

EURUSD at resistance zones.

Conclusions

Given the points made above, it would be risky to bet against the dollar at this turning point. The FED could surprise us all again.

Frictions from a tight monetary policy on certain US economic sectors could be amnestied by unprecedented monetary stimulus, as we saw in the case of the SVB.

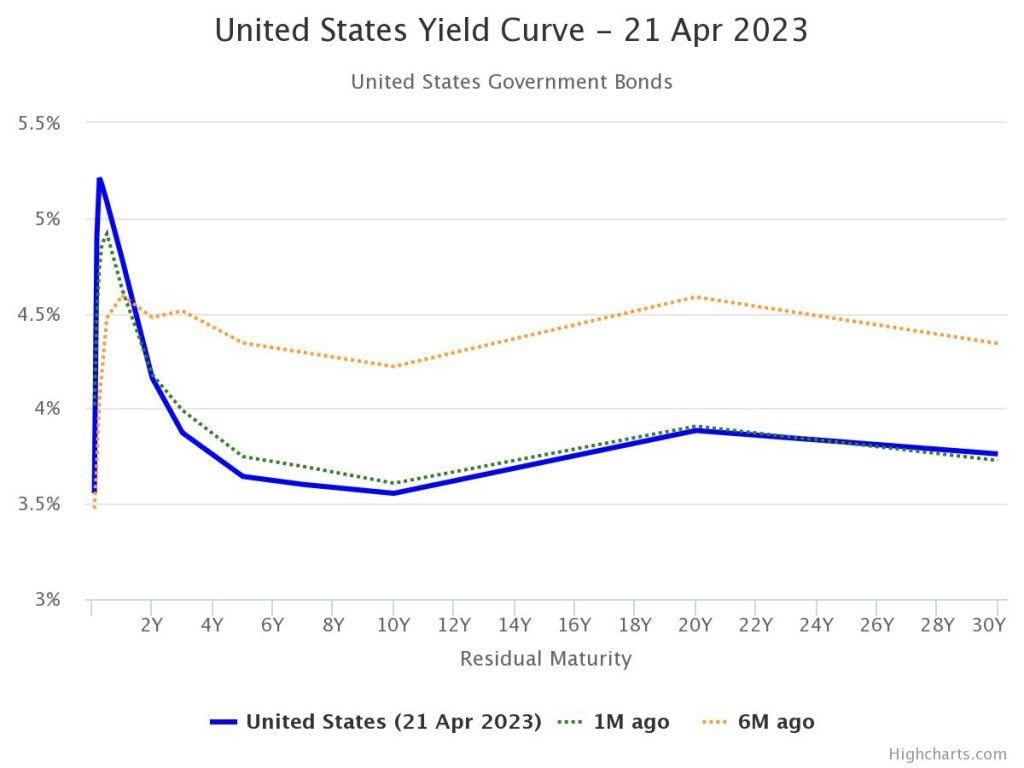

In such a scenario, US bond yields would continue to bend the yield curve. Commodities would retreat in the face of a buoyant dollar, and equity markets would contract.

US Negative yield curve.