- Summary:

- The Tesco share price is hovering near its highest level on record as investors wait for another catalyst. TSCO stock has risen by almost 50%

The Tesco share price is hovering near its highest level on record as investors wait for another catalyst. The TSCO stock has risen by almost 50% in the past 12 months, making it one of the best performing years. This growth brings its total market capitalization to more than 20 billion pounds.

What’s the next catalyst?

Tesco is the biggest retailer in the UK with hundreds of stores. The company also operates other businesses, including fuel stations and a bank. Its e-commerce operation is the fastest-growing segment of its business.

Tesco has benefited substantially from the ongoing recovery of the UK economy. The recovery has seen many retailers struggle to find workers. There have also been significant supply shortages.

However, the company has been relatively immune to all these simply because of its size. The significant size and its presence across the country has made it be able to hire workers and have access to products. Still, the rising inflation has somewhat helped slow the pace of purchases.

Another reason why the Tesco share price has done well is that there have been a lot of interest of UK retailers by investors. Foreigners have already bought companies like Asda and Morrisons. And there is chatter that a deal to acquire a company like Sainsbury’s could happen. Tesco, because of its size, has been excluded from this talk.

The TSCO share price has also done well as investors react to the company’s investments in cashless stores. The company wants to take-on Amazon, which represents a key threat in this division.

Looking ahead, the stock will react to the Bank of England interest rate decision scheduled for Thursday. A hawkish statement will be positive for the company because of its banking operations.

Tesco share price forecast

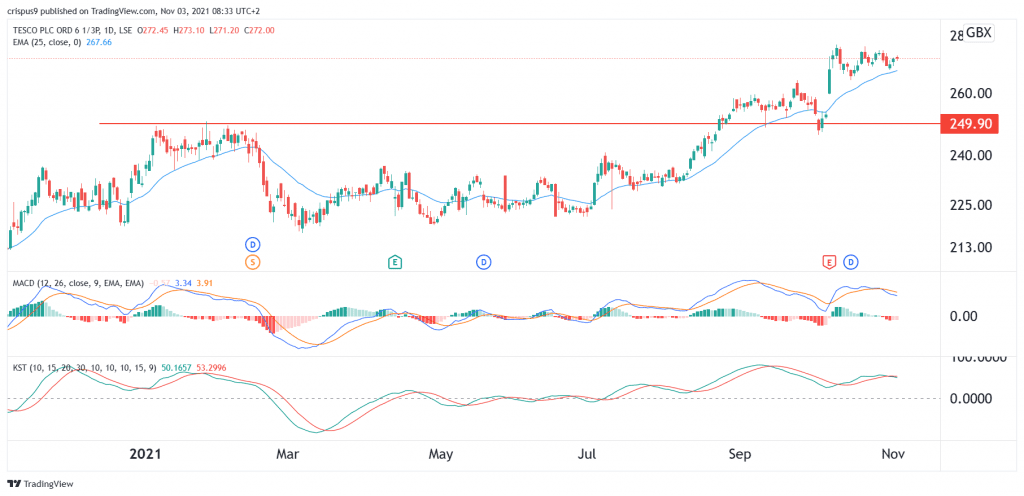

The daily chart shows that the Tesco share price has been in a bullish trend in the past few months. The stock has even moved above the key resistance level at 250p, which was the highest level in January. It is still above the 25-day and 50-day moving averages (MA) while the MACD is above the neutral level. Similarly, the Know Sure Thing indicator has remained above the neutral level.

Therefore, the stock will likely keep rising as bulls target the next key resistance level at 300p. This view will be invalidated if the stock moves below the key support level at 250p.