- Summary:

- The spot Silver price shrugged off the hawkish FOMC and now feels under-invested, which could spark a late-stage recovery before year-end.

The spot Silver price shrugged off the hawkish FOMC and now feels under-invested, which could spark a late-stage recovery before year-end.

Following the expected announcement on December 15th that the US Central bank will accelerate the tapering of bond purchases, Spot Silver (XAGUSD) spiked to a 2021 low of $21.42. However, after the decision, a mildly Dovish press conference helped Silver finish the day in the green at $22.08 (+0.60%). Furthermore, XAGUSD has gained around 3.5% in the six sessions following, clearing the 50-Day Moving Average and improving the technical outlook in the process.

XAGUSD Price Forecast

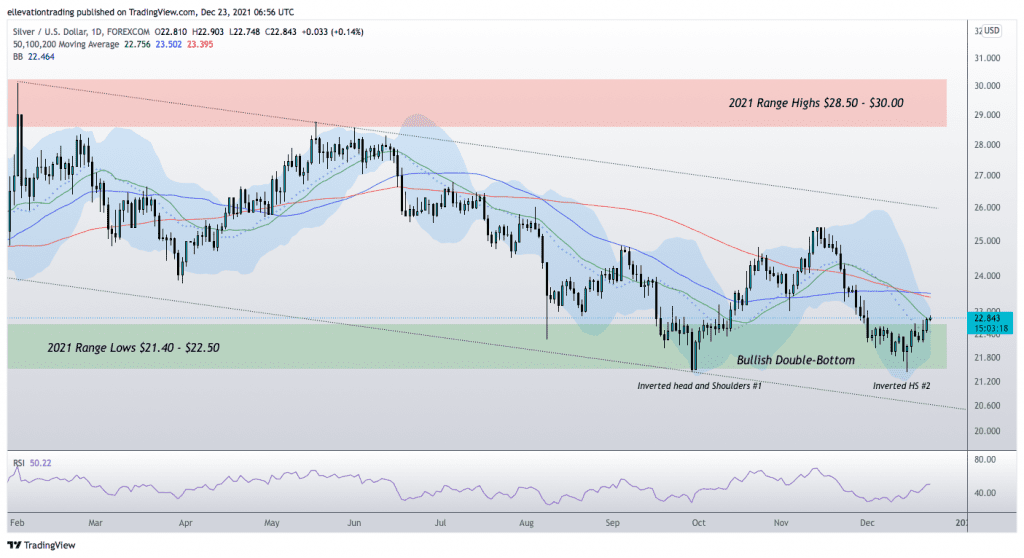

The daily chart shows several potentially constructive developments. Firstly, the recovery on December 15th has left a bullish double-bottom pattern on the chart. Secondly, XAG has cleared the neckline of a concise inverted head and shoulders pattern at $21.60. Finally, the Silver price is on the verge of closing above the 50-DMA at $22.75 today.

A daily close above the 50-DMA should encourage an extension towards the tightly bunched 100 and 200-DMA’s approaching $23.50. Decisive clearance of the 100-DMA at $23.50 flips the DMA’s from resistance to support. In that event, I expect to see sustained short-covering into the November highs around $25.40.

I am friendly towards Silver into Q2 2022, considering the above and Silver’s poor performance in 2021. Although rallies are likely to be capped around $25.00 initially unless Central Banks shift to a more hawkish stance. However, if the price breaks below this year’s low, long liquidation could drive XAG to a $19 handle for the first time since 2020. Therefore, a close below $21.42 invalidates the bullish thesis.

Spot Silver Price Chart (Daily)

For more market insights, follow Elliott on Twitter.