- Summary:

- The Royal Dutch shell share price has been in a strong upward trend since last year. What next for the energy supermajor?

Royal Dutch Shell share price is up by more than 1% today as the price of crude oil rebounds. RDSB shares are trading at 1,422p while RDSA are trading at 1,466p. Similarly, BP share price has jumped by more than 2% and is the second-most traded today after Lloyds. It is trading at 300p, which is 70% above last year’s low.

What’s happening: Shell share price has been in an upward trend this year, helped by the rising price of oil. It has risen by more than 10%, becoming one of the best performers in the FTSE 100. In the same period, oil has jumped by more than 10% and is now at the highest level since March last year. Companies like Shell usually benefit when the price of oil rises.

This performance has been due to the recent decision by Saudi Arabia to slash production by 1 million barrels. This helped to boost the price of crude oil to the highest level since March. Also, the ongoing vaccinations and stimulus in the US has helped boost this price.Key risk: Still, Shell share price faces key risks. For example, the number of coronavirus cases in the United States and China is rising. This means that the price of oil could be under pressure in the near term. Second, there is a major issue about rising production in the United States. Data released last week revealed that shale producers have increased their active rigs for the past seven consecutive weeks.

Shell share price technical outlook

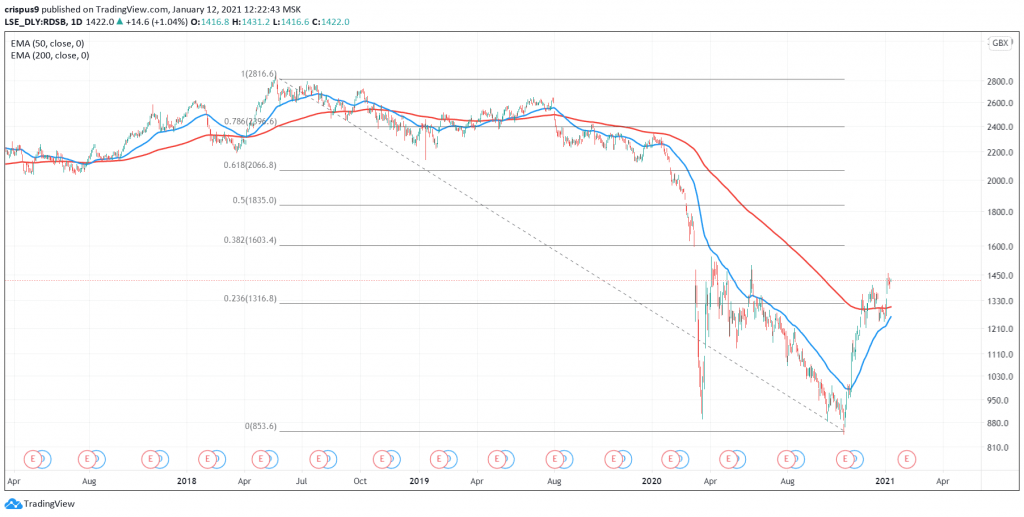

On the daily chart, we see that the RDSB share price has been on an upward trend. It has risen by more than 70% from the lowest level last year. Also, the 50-day and 200-day EMA are forming what seems like a golden cross. This is usually a bullish signal. Also, it has already crossed the 23.6% Fibonacci retracement level and is approaching the 38.2% retracement level at 1,603p.

Therefore, Shell share price will likely continue rising as bulls aim for the 38.2% Fib level. However, a drop below the 23.6% retracement will invalidate this trend.

RDSB share price chart