- Summary:

- What is the outlook of the Barclays share price? We explain whether the company is a good investment and what to expect

The Barclays share price dropped sharply on Thursday as investors reacted to that Russian invasion of Ukraine. The BARC stock declined by more than 8%, becoming one of the worst-performing bank stocks in the FTSE 100 index. It is trading at 179.40p, which is the lowest it has been since December 21st. It is also about 18.20% below the highest level this year.

Barclays earnings review

Barclays is one of the biggest British banks that has operations globally. The firm offers a number of services that target retail and institutional customers. For example, in the UK, the bank offers mortgages and credit cards. In addition, Barclays offers numerous services like investment banking and wealth management in its international segment.

The Barclays share price declined this week even after the company published strong results. The firm said that its total income in the fourth quarter of 2021 was more than 5.2 billion pounds. Its profit before tax came in at 1.5 billion pounds while its earnings per share was 6.6 pence.The company’s income was 21.9 billion pounds for the year, while the profit before tax was 8.4 billion pounds.

This growth was driven by the strength of its investment banking division as the number of deals reported in 2021 jumped. It is unclear whether this deal-flow will continue this year, considering that American and European regulators have started focusing more on antitrust issues. For example, recently, Nvidia decided to abandon its takeover of Arm Holdings.

Is Barclays a good investment?

Analysts believe that Barclays share price is a good investment for several reasons. First, unlike companies like Lloyds, it is a highly diversified group with numerous revenue sources. The benefit of this diversification was seen during the pandemic. At the time, the income from its investment bank and fixed income currencies and currencies (FICC) division helped offset interest income. The same trend will likely continue in the coming years as central banks like the Bank of England (BOE) embrace a more hawkish tone.

As a result, higher interest rates will be net positive for Barclays’ retail business. This income will help to offset the weakness of the investment banking division. However, like all banks, the Barclays share price faces several risks going forward. The most urgent one is the ongoing crisis in Europe. As more countries punish Russia, there is a risk of cyberattacks in the banking sector. Another risk that could drag the BARC share price is if the housing sector starts to slow. Some analysts even have the next housing crash predictions.

Barclays share price forecast

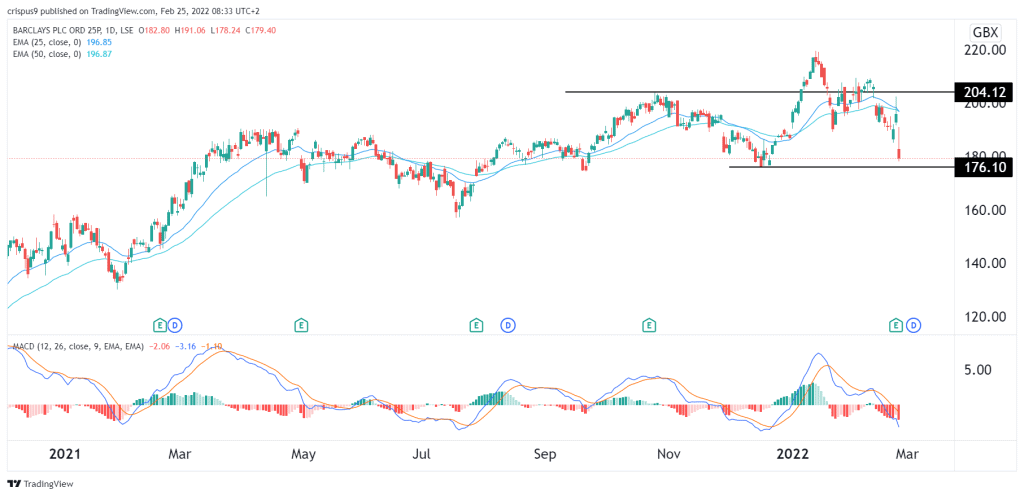

The daily chart shows that Barclays share price dropped sharply on Thursday as the crisis in Europe continued. This crisis pushed more investors to ignore the strong earnings by the bank. The stock is trading at 179p, which is a few points above the key support at 176p, which was the lowest level in December.

The Barclays stock price has moved below the 25-day and 50-day moving averages, while the MACD has moved below the neutral level. Therefore, the short-term outlook of the stock is bearish considering that it has even formed a head and shoulders pattern. The next key target is 170p, while the invalidation point is 185p.