- IRFC share price has fallen further down below Rs 180, and that could strengthen the downside momentum as some investors look to take profits.

Indian Railway Finance Corporation (IRFC ) share price declined further on Tuesday, reflecting the wider market sentiment as jitters over the performance of the US economy seeped in. IRFC (NSE: IRFC) traded at Rs 177.20, down by -1.2 percent on the daily chart, adding on to Monday’s -6.7 percent to portray a market dominated by the bears.

The IRFC share price trajectory has been headed downside since mid-June when it hit record highs of Rs 229.00, and has since declined by 23 percent from that level. Nonetheless, the stock is still up by 77 percent year-to-date and up by 285.2 percent over the last 52 weeks. That means that the buyers are technically in control of the market.

However, the current bearish global stock , market sentiment may exert pressure too heavy to bear, which puts many stable stocks at a risk of a selloff, IRFC included. Indian stocks have rallied upwards for the better part of the year, and there’s the risk that many investors could opt to lock in their profits at this point in time rather than risk a potential recession-driven nosedive. That said, IRFC announced on Tuesday that it will release its first quarter FY 2025 results on August 12, and that could provide fresh volatility in the coming days.

IRFC share price momentum

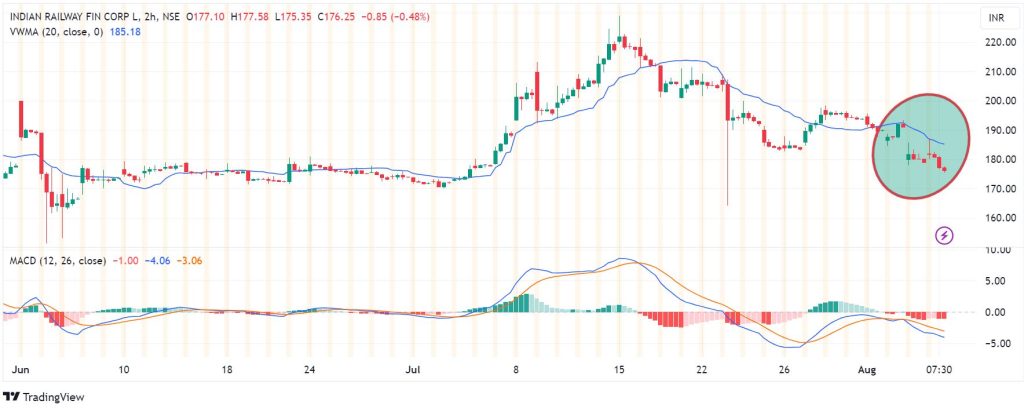

On the 2-hour chart, the IRFC share price is currently below the Volume Weighted Moving Average (VWMA) line, signaling control by the sellers. In addition, the Moving Average Convergence Divergence (MACD) line is below the signal line, affirming the bearish-leaning view. A return to levels corresponding to the VWMA mark of Rs 185.14 could provide the momentum to sustain an upward trajectory.

Support and resistance levels

The momentum on IRFC share price favours control by the sellers if resistance persists at 179.00. With the sellers in control, the first support could come at 176.78, but extended control could lead to further downside to test 175.00. Alternatively, the buyers could take control above 179.00. In that case, the upside could encounter the first resistance at 180.60. However, extended control by the buyers could break above that mark, and invalidate the downside narrative. Also, such a gain could provide a pathway for the stock to test 182.50.