- Summary:

- The Invesco QQQ share price could continue its recovery move after jobless claims fell to the lowest levels since the pandemic began.

The uptrend in the Invesco QQQ share price appears to have stalled at the $375.73 resistance level, and this is slowing down the uptrend for the Invesco QQQ Nasdaq ETF. This exchange-traded fund which tracks the Nasdaq 100 index, has seen significant upside after the US indices continued to show bullish trends in the last few weeks.

The markets appear to have priced in the tapering action of the Fed, scheduled to start in November. Even recent economic woes out of China seem not to have done a lot of damage to the ETF. Instead, broad market ETFs have done well, even as government bond yields touched off 5-month highs on Thursday. Initial jobless claims also fell to their lowest levels since the onset of the pandemic, which boosted market sentiment and appetite for the Invesco QQQ price.

Thursday’s price activity violated the resistance at 375.73 without achieving the required price filter. Friday’s price action has resulted in a pullback of 0.40%.

Invesco QQQ Share Price Outlook

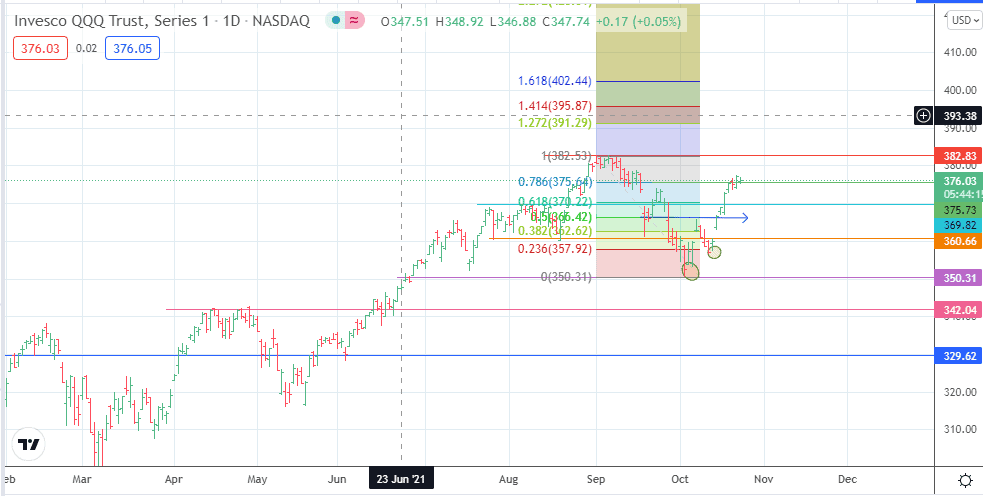

The price is currently testing resistance at 375.64 (10 September low). If the bulls uncap this resistance, the all-time high at 382.78 comes into focus. If the uptrend continues from a breach of this resistance, new targets to the upside will present at 391.29 (127.2% Fibonacci extension) and 395.87 (141.4% Fibonacci extension level). 402.44 is another potential upside target found just above the 400.00 psychological barrier at the 161.8% Fibonacci extension level.

On the flip side, rejection and pullback from the current resistance will target 369.82 initially, before 360.66 and 350.31 become additional targets to the south. The former neckline of the completed double bottom pattern may also form a potential pitstop for the bears at 366.42

Invesco QQQ Price Chart (Daily)

Follow Eno on Twitter.