- Intel stock price bounced back as investors cheered the new Mobileye listing and the company’s results. INTC shares rose by more than 7%

Intel stock price bounced back as investors cheered the new Mobileye listing and the company’s results. INTC shares rose by more than 7% in extended hours to $27,69. It has crashed by more than 40% this year and by 60% from its highest level this year. At the same time, after popping on its first day of trading, Mobileye stock price pulled back by almost 2%.

Intel earnings and Mobileye listing

It has been a good week for Intel. On Wednesday, the company took Mobileye public in a successful listing. The firm acquired the company in 2018 at a time when most investors were focusing on self-driving cars. Mobileye is now valued at more than $1.2 billion.

Intel stock price rebounded after the company published encouraging results. Its total revenue declined by 15% year-on-year to $15.34 billion. This decline was nonetheless better than the median Wall Street estimate by $29 million. Its earnings per share rose to 59 cents.

The company lamented about the deteriorating consumer PC market. It expects that the total PC units will fall by mid to high teens to about 295 million units this year. For 2023, Intel expects that total PC shipments will be between 270 million and 295 million.

Intel also warned that China’s data center industry was struggling as the country braces for a significant output slowdown. This is partly because of the red-hot US dollar, which has risen by about 10% against the Chinese yuan.

Meanwhile, Intel is also cutting costs aggressively. It expects to reduce costs by about $3 billion this year and by between $8 billion and $10 billion by the end of 2025.

So, is Intel stock a good buy today? Intel is a good company operating in a slowing and highly competitive industry. It is now battling competition from the likes of AMD and Nvidia at a time when key segments are slowing. This is reflected in its lowered revenue guidance to between $63 billion and $64 billion.

On a positive side, I believe that this year’s headwinds will become next year’s tailwinds. For example, the US dollar could retreat in 2023 while PC demand could start rebounding as the upgrade cycle starts.

Intel stock price forecast

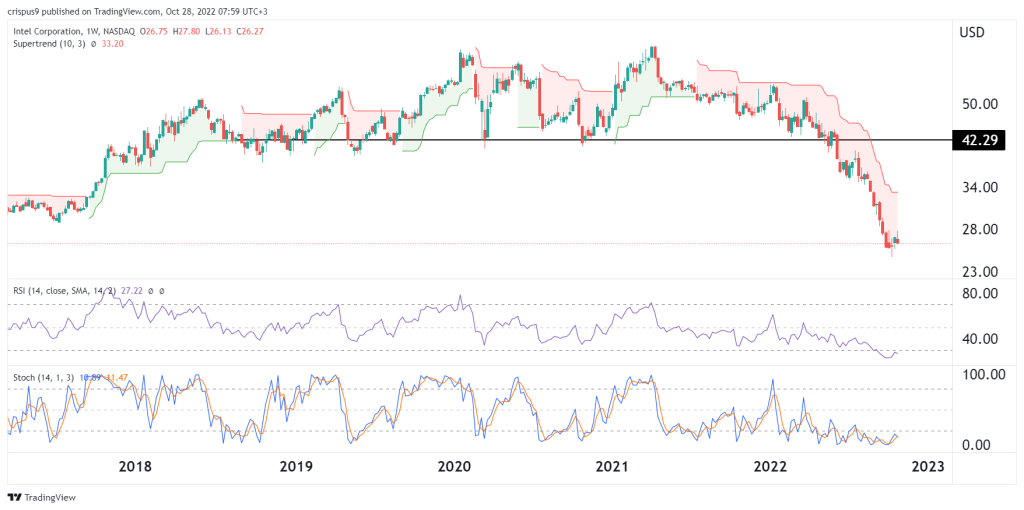

The weekly chart shows that the INTC stock price has been in a strong bearish trend in the past few months. In this period, it has dropped in the past ten straight weeks. As a result, the Stochastic Oscillator and the Relative Strength Index (RSI) have all crashed below the oversold levels. The bearish trend is being supported by the Supertrend indicator.

Therefore, for now, the outlook for the stock is still bearish. If this happens, the next key support level to watch will be at $20. A move above the resistance at $30 will invalidate the bearish view.