- The Dow Jones Index rose to the milestone 50,000 points for the first time in early February

- Investors are past the initial AI excitement phase and are now keen on returns generated from the high AI capex

- Federal Reserve interest rates and US economic data will be key to defining Dow Jones Index trajectory

In early February 2026, the Dow Jones Industrial Average hit 50,000 for the first time on February 6. At that point, it was up over 4% for the year, showing investors felt good about how American companies were doing. But, by February 17, it had fallen back to around 49,533.

Many say this is just a normal dip in a rising market. However, a closer look shows problems in tech and artificial intelligence could hold the index back longer than some think.

Why the 50,000 Pinnacle Proved Slippery

The drop from the peak mostly came from more selling of tech and software stocks, with worries about artificial intelligence causing problems. CNBC reported on February 17 that the drop in software stocks hurt the overall market, leading to a slight weekly loss for the Dow.

Investors seem to have sold off some expensive stocks after the quick climb to 50,000, taking profits amid worries about high prices and slower-than-expected returns from artificial intelligence investments. Most think 50,000 is a point that’s hard to pass without something big happening.

But, while everyone talks about that number, the strength of old-fashioned companies in the Dow, like Caterpillar and Chevron, suggests the index is in better shape than the price suggests. The main worry isn’t failing to reach 50,000. It’s the chance of a price squeeze in the financial sector if the Federal Reserve keeps rates high for longer than expected.

Is a Return to 50,000 Viable in the Near Term?

It’s possible to get back to 50,000 soon, but it’s not a sure thing. Good news on economy, like lower inflation or solid job numbers, could help. Yet, the index faces resistance near its recent highs. How quickly it recovers depends a lot on upcoming reports on inflation and GDP, along with earnings from big industrial and financial companies.

Some things could limit gains or cause further drops. High prices in tech stocks, along with disappointment related to artificial intelligence, are a risk. Also, global tensions and uncertain policies on tariffs could mess up supply chains and company profits.

Dow Jones Index Forecast

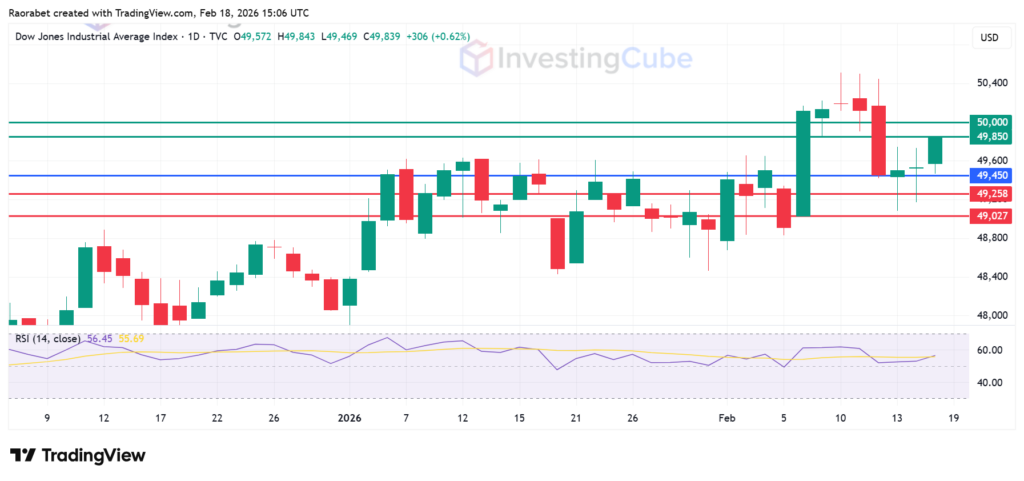

Dow Jones pivots at 49,450 and action above that level signals control by buyers. Immediate resistance is at 49, 850, points, and a break past that will bring 50,000 points within reach. On the other hand, action below 49,450 will favour the sellers to take control. Immediate support is at 49,258. A decisive daily close below this could see the index tumble toward 49,027.

Dow Jones Index on the daily frame with key levels of resistance and support on February 18, 2026. Created on TradingView

The drop was mainly due to profit-taking and worries that a strong job market will keep interest rates high longer. Also, big AI-related spending by major companies raised concerns about profits.

Yes, but it hinges on the upcoming FOMC minutes. If the Federal Reserve hints at a more dovish stance despite the strong jobs data, we could see a return back above 50,000 within weeks.

The main risks include elevated valuations in key components, potential AI-related disappointment, and policy uncertainties around tariffs. These could limit upside more than many currently expect.