- Summary:

- The fundamentals and 4th quarter/full-year 2021 earnings call could impact the Idex stock forecast 2022, 2025 and beyond.

Table of Contents

IDEX is the stock symbol of Ideanomics Inc, a global electric vehicle company listed on the Nasdaq index. The company is pushing for enterprise-level adoption of commercial electric vehicles and green energy usage and is developing products along this direction.

Consequently, it is involved in financing, leasing, and energy management for operators of commercial fleets. Founded in 2004, the company’s headquarters is in New York City, NY, United States of America.

The company has undergone many name changes to reflect its acquisitions and ownership structure. It was first founded as China Broadband Inc but was renamed Ideanomics Inc in 2017. Over the years, companies it has acquired include Solectrac, an electric tractor maker, and Wave, which provides wireless charging services. It also has several subsidiaries: US Hybrid, Treeltrik, and VIA Motors.

IDEX Stock News

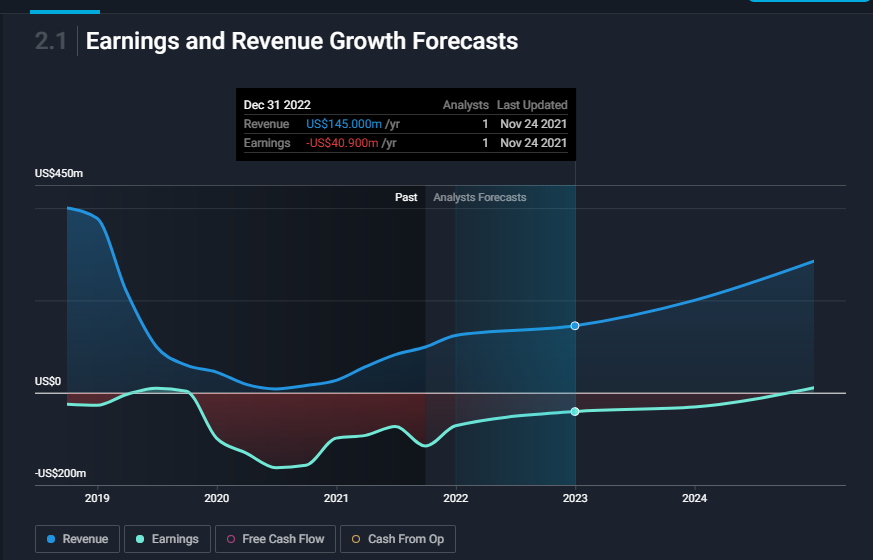

The latest IDEX stock news concerns the full-year results for the 2021 fiscal year. The 4th quarter 2021 and full-year financial results will be made public on Tuesday 1 March 2022. The results will be released in the after-hours trading period. The earnings for 2021 will have a definite impact on the IDEX stock forecast 2022 and beyond.

The 3rd quarter earnings report for 2021 was disappointing, as the revenue of $27.05m missed the consensus estimates by nearly 17%, despite beating the revenue for the same period in 2020. This contributed to the downward trend of the stock in the 4th quarter. As a result, the stock underperformed in 2021 relative to the S&P 500 index.

You can check Ford Stock Price Forecast.

Will Idex Stock Go Up?

Will IDEX stock go up? Technically speaking, the price picture on the daily chart does not support an immediate price move to the upside. The price dipped below the 0.99/1.21 support zone and has not been able to go above it. This means that there is still some room for the price to deteriorate.

The IDEX stock will need some fundamental push and the right interplay of price and key areas on the chart for the bullish reversal. Presently, the only fundamental prop on the horizon is the upcoming full-year results earnings call. This report needs to head to the upside, with the revenue and profits beating estimates before some demand returns to the stock.

IDEX stock forecast 2022

The Ideanomics stock forecast for the short-term indicates that the stock may struggle a bit before recovering above the $2 mark. The IDEX stock forecast for 2022, a medium-term outlook, envisages a situation where the price trades between 0.26 and 1.84. There are several support and resistance targets between these two price boundaries.

Beyond the IDEX stock forecast 2022, the stock has the potential to break above the $2 mark. Here are some positives that favour this price move.

- Ideanomic’s US hybrid unit signed a $5.5m purchase order from Global Environmental Products for battery powertrain kits to be used in the latter’s electric street sweepers. These will be delivered later in 2022.

- Ideanomic’s US Hydrid also secured an order for 19 battery-electric vans for long-range transit, to be used by the Antelope Valley Transit Authority. This deal was announced just over a week ago.

These new deals show where the world is heading in powering engines and vehicles.

You may be interested in HCMC Stock Forecast.

IDEX stock forecast 2025

There is a great potential for recovery in the IDEX stock forecast 2025 than it would be for earlier years.

At this time, the Fed is expected to have raised rates at least three times, and the impact of this metric on the markets would have reduced. Also, companies worldwide are expected to have recovered a lot more from COVID-19’s economic impact. As a result, there would have been a more significant adoption of electric vehicles and car charging accessories. It is also expected that the partnerships signed by IDEX would have started to kick in, and these should drive demand and the share price upwards.

The IDEX stock forecast 2025 is a medium-to-long-term outlook, and for this, we turn to the weekly chart for direction. The candles are setting up for a possible rejection at the broken support zone, which now serves as the immediate resistance.

Rejection at this point brings the 0.99 support into the picture as an immediate downside target, followed by 0.77 and 0.26. Any demand-driven bounce from these areas must first take out the price zone between 0.99/1.21 before the sky becomes clear for an approach to be made at 1.84 (16 September 2019 high and 18 October 2021 low).

Additional price targets for 2025 include 2.26, 2.81, and 3.37. A recovery above 3.37 allows the 4.00 psychological resistance and 22 June 2020 high to become the next target.

Is IDEX a Good Stock to Buy?

In my judgment, IDEX is a good stock to buy at current prices. It is relatively cheap compared to other EV car companies such as Nio and Tesla. In addition, it is racking up strategic partnerships along the way, making it a competitive player in a post-fossil-fuel-driven world.

Several countries will end fossil fuel usage between 2025 and 2030. This puts the company in an excellent place to dominate aspects of the EV value chain.

A medium-term outlook of 3-5 years must be the investment focus for anyone who wants to take a position on IDEX now.

Summary

The IDEX stock forecast from 2025 onwards looks positive. With lower prices than most EV companies in the market presently, stocks like Ideanomics appear to be an attractive investment for those seeking medium-term and long-term exposure in the EV market for good returns.

IDEX: Weekly Chart

Follow Eno on Twitter.