- Summary:

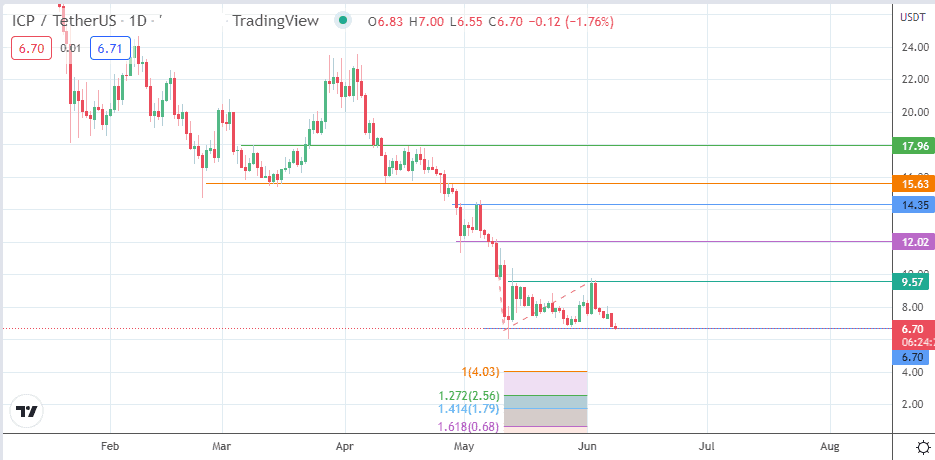

- The ICP price prediction indicates the potential for the token to lose a further 40% of its value unless the bulls defend the 6.75 support.

How does a token which traded as high as $2831 end up trading at just under $7? This is the sad story of the Internet Computer Protocol token, which has been hit by all manner of issues that have dictated the current bearish ICP price predictions. If you thought the stock had seen its worst days, you might be in for a shock as the emerging pattern on the daily chart suggests that things may not get better anytime soon.

In September 2021, the Dfinity blockchain project made its foray into the NFT world, but ICPunks, its first NFT collection, ran into several hitches. The subnet which hosted the smart contract could not correctly interact with the NFT website due to very high user traffic. At this time, the token was trading at $87. Soon after, the steady slump began, with ICP hitting off low after low until it got to its present point.

So what is the current ICP price prediction? In the absence of any bullish fundamental triggers, the price patterns will determine future price action. Presently, only the 6.75 support level (28 May low) is holding the token from hitting new lows, but this point is now at a point of maximum vulnerability.

Here are the possible scenarios.

ICP Price Prediction

A breakdown of the 6.70 support is in the offing unless the bulls do something radical to save the token from slipping into uncharted waters. If the bulls defend this support, a bounce carries the ICP/USDT pair to the 9.57 resistance. There is a potential pitstop at the 8.00 psychological price mark. Above these levels, 12.02 and 14.35 form additional targets to the north.

On the flip side, any rallies may be seen as potential areas for setting up shorts. These will ultimately seek a breakdown of the 6.75 support. If this support level is degraded, the following targets could come in at 4.03 and 2.56. These are the 100% and 127.2% Fibonacci extension levels from the 9 May to 12 May swing and completed at the 2 June high.

ICP/USDT: Daily Chart