- The ICICI Bank share price has held relatively steady in the past few days as investors focus on the Indian economy.

The ICICI Bank share price has held relatively steady in the past few days as investors focus on the Indian economy. The stock is trading at Rs 724, which is above June’s low of Rs 671. For the year, the shares have fallen by more than 6.40%, meaning that they have outperformed global banking stocks. The closely watched SPDR Bank ETF (KBE) has crashed by more than 20%. It has also done better than the Nifty 50, which has fallen by over 10%.

ICICI is outperforming

ICICI Bank is one of the biggest companies in India. It has a total market cap of over $63 billion, making it the 5th biggest firms in the country. The other biggest firms in the country are Reliance Industries, Tata Consultancy, HDFC Bank, Infosys, and Hindustan Unilever.

ICICI Bank has over Rs 15.75 trillion in total assets, and it generates a profit after tax of over Rs 161.93 billion in profit. The company provides all banking businesses, including consumer loans, investing solutions, insurance, and fintech services like bill payments. ICICI also has a division that caters to businesses.

ICICI Bank share price has done relatively well this year because of the resilience of the Indian economy. The economy expanded by 8.7% in FY 2022 and soared to over $3 trillion. It is expected to become the fifth-biggest economy in the world soon. This growth has been helped by the fact that India is still receiving cheaper energy from Russia.

The stock has also done well because of the recent actions by the Reserve Bank of India (RBI). After being cautious for months, the bank has embarked on a tightening phase in a bid to fight the soaring inflation. Therefore, ICICI will likely generate more interest income this year.

Analysts are optimistic about the ICICI share price. For example, those at Axis Bank expect the shares to rise to 1000 Rs this year. Similarly, those at Chandan Taparia expect it to rise to Rs 745, while Jefferies sees a 55% upside.

ICICI Bank share price forecast

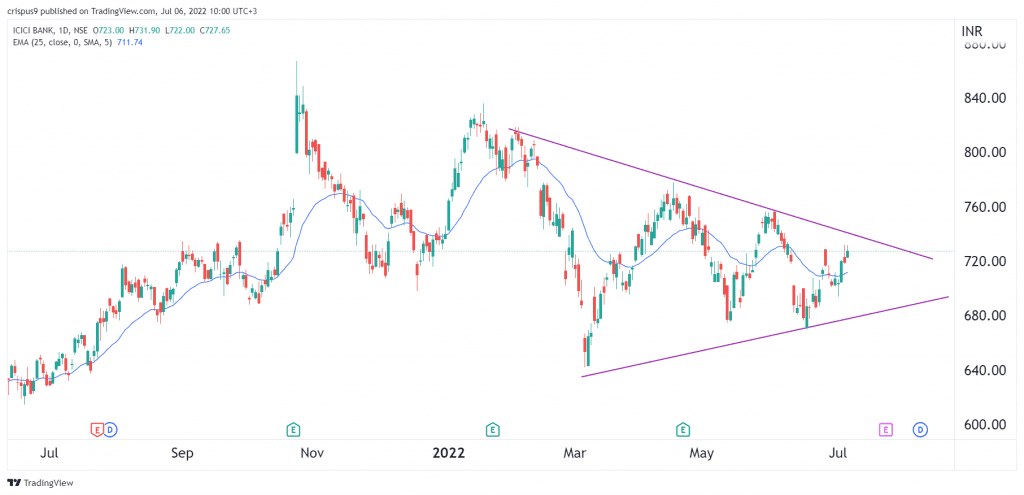

The daily chart shows that the ICICI share price has consolidated in the past few weeks. Along the way, the stock has formed a symmetrical triangle pattern that is shown in purple. It has also moved slightly above the 25-day moving average.

Therefore, since this is a symmetrical triangle, the outlook of the stock from a technical standpoint is neutral with a bullish bias. With the triangle nearing its peak, the stock will likely have a bullish breakout soon. If this happens, the key resistance to watch will be at Rs 800. A drop below the support at Rs 700 will invalidate the bullish view.