- Summary:

- The IAG share price has spiked 6% in anticipation of the UK government's relaxation of COVID-19-associated travel rules.

The IAG share price has bounced back to life this Friday, topping the gainers’ chart on the FTSE 100 index, ahead of a major overhaul of travel rules in the UK.

Reuters quoted agriculture minister George Eustice as saying that the UK government would consider easing some COVID-19 travel restrictions on Friday, which would provide much-needed relief to travel, hospitality, and leisure companies.

The IAG share price could benefit massively from a transition of several countries from the red list to the amber list, in a major shakeup of traffic light classification system that uses the local COVID-19 caseloads and the presence of the delta variant to determine entry and quarantine rules. IAG conducts long haul passenger flights, which have been heavily affected as travellers from amber and red-listed countries have stayed home, denying IAG and other aviation companies much-needed revenue for their operations.

Investors are snapping up IAG’s stocks in anticipation of the relaxation of the rules, spurring a rise in the IAG share price by 5.91% as of writing.

IAG Share Price Outlook

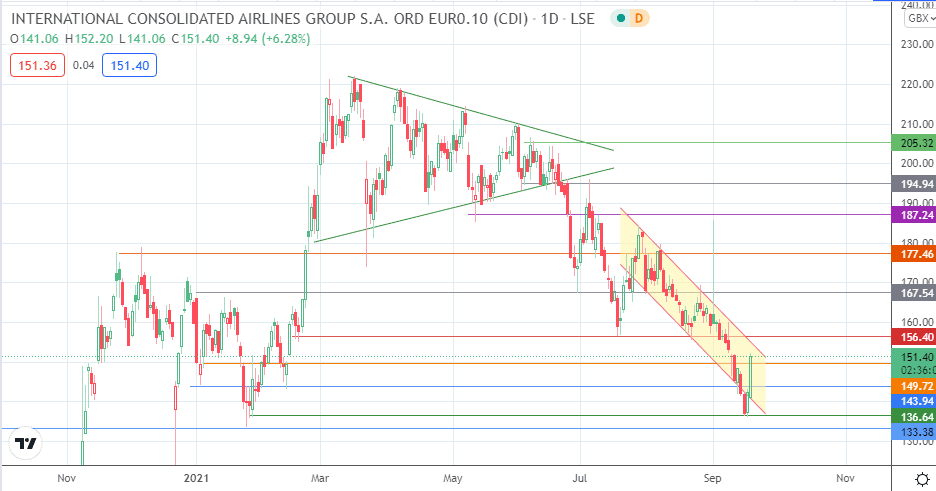

Friday’s spike extends a V-shaped recovery, taking out the 143.94 resistance and violating the 149.72 upside barrier. Bulls need to drive prices above the channel, taking out 156.40 in the process, for a further recovery towards 167.54. 177.46 and 187.24 are additional upside targets that only become visible if 167.54 gives way.

On the other hand, a further decline in the IAG share price follows a breakdown of 136.64, with 133.38 coming into the picture as the immediate downside target following this breakdown. This move requires the bears to drive a retreat below 143.94, which now functions as a support level.

IAG Share Price: Daily Chart

Follow Eno on Twitter.