- Summary:

- The IAG share price has been in a tight range in the past few days as investors watch the performance of the aviation sector.

The IAG share price has been in a tight range in the past few days as investors watch the performance of the aviation sector in Europe and other countries. The stock moved to a low of 108.38p, which was slightly above this week’s low of 104.70. This price was about 77% below the highest level on June 18 and about 51% below the highest point this year.

Aviation stocks in trouble

IAG shares have had it rough in the past few weeks as concerns about the aviation sector remains. This performance is in line with that of other companies in the sector. For example, Delta Airlines stock price has dropped by over 32% from its highest level this year. Similarly, EasyJet share price has tumbled by 62% from its highest point in 2021 while Wizz Air are down by over 60%.

IAG shares have crashed even as demand for flying has jumped sharply in the past few months. Indeed, the company’s capacity has risen as countries end their Covid-19 restrictions. As a result, the company managed to move back to profitability. Its profit rose to 293 million euros in the second quarter after it generated a loss of more than 967 million euros in 2021.

The stock has underperformed because of the soaring jet fuel prices and the ongoing crisis in the sector. For example, British Airways, the company’s biggest subsidiary, said that it will cancel 10,000 flights in winter.

IAG share price forecast

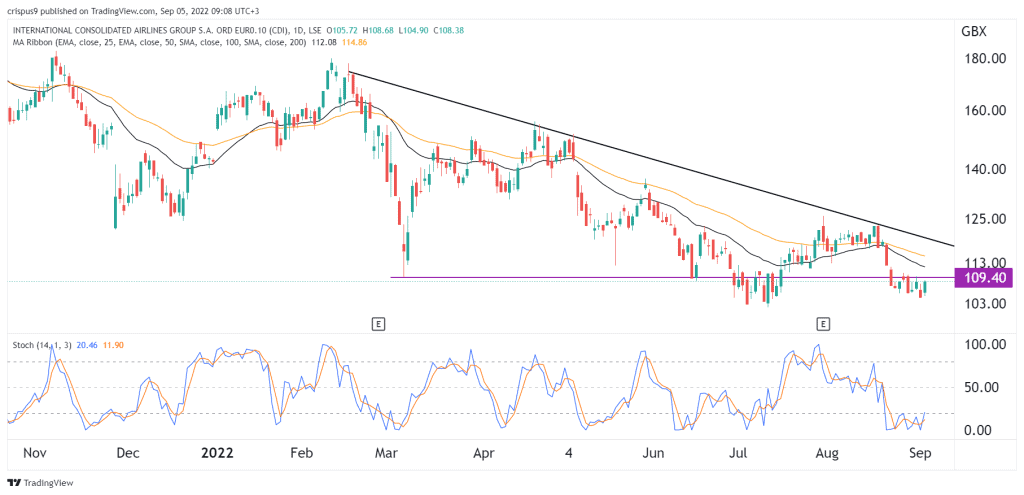

The daily chart shows that the IAG stock price has been in a strong bearish trend in the past few months. Along the way, the shares have moved below the descending trendline shown in black. It has also moved below the 25-day and 50-day moving averages.

At the same time, the stock moved slightly below the important support level at 109.40p, which was the lowest level on March 7. Therefore, the IAG share price will likely continue falling as sellers target moving below the important support at 100p. A move above the resistance level at 113p will invalidate the bearish view.