- Summary:

- The IAG share price tilted lower on Friday after the company reported relatively strong quarterly results. The stock dropped to 64p

The IAG share price tilted lower on Friday after the company reported relatively strong quarterly results. The stock dropped to 64p, which was about 12% above the lowest level in October. Other airline shares like EasyJet, Ryanair, and Wizz Air have also tiled higher.

British Airways parent earnings

IAG, the giant parent of British Airways, reported relatively strong quarterly results on Friday. The company said that its cash flow moved in the positive territory in the third quarter. The firm also said that its North American bookings have jumped sharply in the past few weeks. It said that its long-haul bookings were rising at a faster pace than short-haul ones. The CEO said:

“Longhaul traffic has been a significant driver of revenue, with bookings recovering faster than short-haul as we head into the winter. Premium leisure is performing strongly at both Iberia and British Airways and there are early signs of a recovery in business travel.”

The results showed that the company’s revenue in the nine months to September 30 was about 4.92 billion pounds. This performance was relatively lower than the 6.5 billion that it made in the same period in 2020. However, its net loss narrowed to about 2.6 billion pounds while its net debt rose to more than 12 billion pounds.

IAG share price forecast

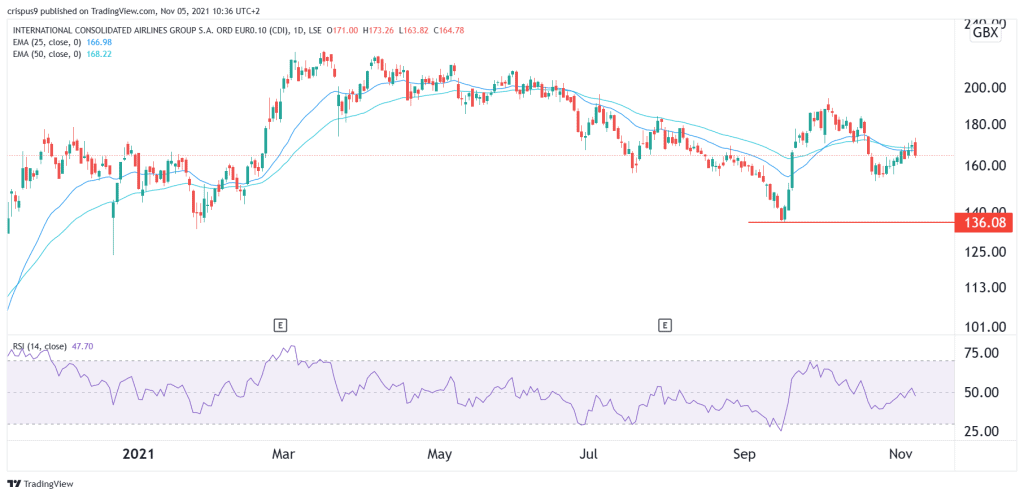

Turning to the daily chart, we see that the IAG share price has been in a steady bullish trend in the past few days. The stock is along the 25-day and 50-day moving averages. At the same time, the stock has formed what looks like a rising wedge pattern. In price action analysis, this pattern is usually a bearish signal.

Therefore, the stock will likely have a bearish breakout as bears target the next key support at 153p, which was the lowest level on October 22. This view will be invalidated if the price moves above 180p.