- Summary:

- The IAG share price will face a test at a key resistance after the LHR management directed a ticket sales cap yesterday.

Tuesday’s surge in the IAG share price could be put to the test today as the price action aims to beat a key resistance at 110.26. This comes as investors pause to study the directive of the London Heathrow Airport (LHR) authorities to airlines, asking them to halt ticket sales as it applies a passenger cap.

According to a Reuters report, the London Heathrow Airport management has applied a passenger cap of 100,000 passengers a day to stop queues, flight cancellations and baggage delays after airlines struggled to satisfy the unprecedented surge in travel demand following the COVID-19 pandemic. Staff shortages and a rise in passenger traffic due to the holiday season have overwhelmed many airlines, including the IAG Group’s British Airways. British Airways has already cut 10,300 short-haul flights between August – October 2022 to reduce the impact of disruptions on passengers.

The cap will be in place from 12 July to 11 September and follows similar curbs in flights and ticket sales applied by Schipol and Frankfurt airports.

The IAG share price had rebounded strongly on Tuesday after a last-ditch deal that saw a vastly improved pay offer for check-in staff averted a looming strike by its airport workers.

IAG Share Price Forecast

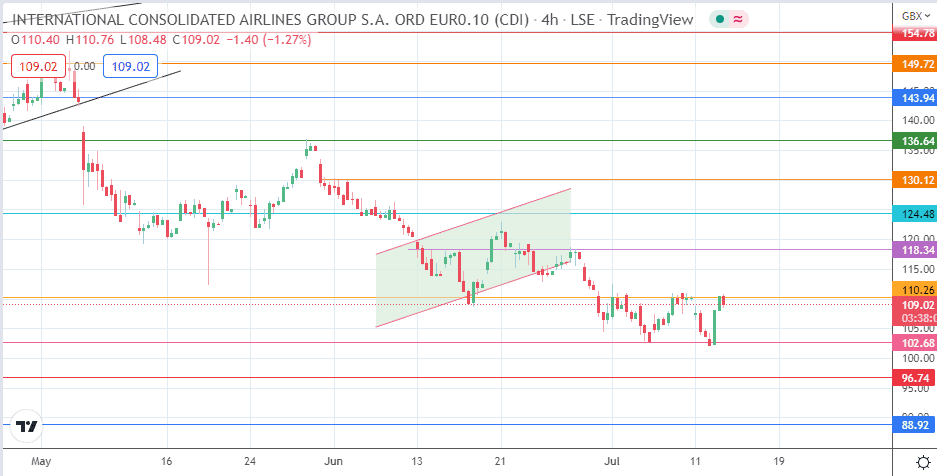

The bounce on the 102.68 support comes from completing the bearish flag’s measured move to the south. This bounce is now challenging the resistance at the 110.12 price mark, where the previous high of 8 July is found.

A break of this price level targets 118.34 (14 June and 28 June highs) initially, with additional price targets at 124.48 and the 130.00 psychological resistance coming into the picture if the bulls take out this initial upside target. The 30 May high at 136.64 comes into the picture on a further advance, while 143.94 is an additional upside target which presently remains out of reach.

Conversely, rejection at 110.26 opens the door for a pullback that aims for the 102.68 support level. Additional targets to the south reside at 96.74 (27 October 2020 low) and 88.92, where the previous lows of 2/3 November 2020 are found.

IAG: 4-hour Chart