- The IAG share price could hit the 136p price mark if the new Boeing order generates sufficient investor demand.

The IAG share price is up slightly this Friday and is a follow-up to the forceful rejection of Thursday’s intraday low by the bulls. This follows an order for 50 Boeing 737 MAX jets by the International Consolidated Airlines Group (IAG). The acquisition comes as the company starts a move to diversify its fleet from the Airbus planes.

The news is a welcome relief for the IAG share price, which has had a torrid month because of flight disruptions and a disagreement between the British Airways Pilots Association (BALPA) members and the company’s management over salary cuts.

BALPA’s members voted against taking salary cuts to pay pilots who found themselves out of work when the peak of the COVID-19 crisis grounded global aviation. In addition, BALPA has argued that the airline’s potential return to profitability with the return of full pay to directors does not warrant its members taking any pay cuts.

The plane purchase deal also contains an option for IAG to purchase an additional 100 aircraft if shareholders approve. IAG Chief Executive Luis Gallego says the purchase of new Boeing 737 aircraft will improve the company’s short-haul fleet. Investors seem to agree, as shown by yesterday’s strong rejection of price from the initial lows, which has continued today as a 2.87% rise as of writing.

IAG Share Price Outlook

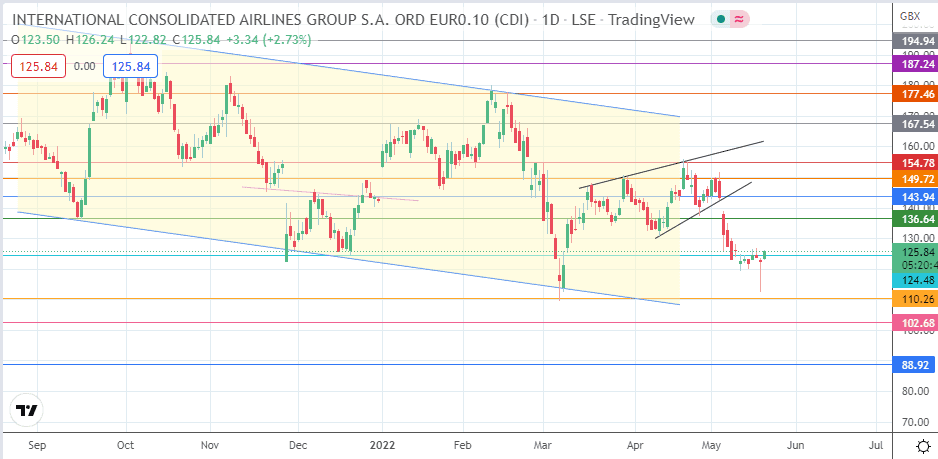

The IAG share price met our expectations of a breakdown from the rising wedge pattern. This breakdown move is currently testing support at 124.48 after the bulls strongly resisted the breakdown of this level with the 19 May hammer candle. The intraday uptick needs to close above this price mark to preserve 124.48 as a support. If this is successful, the bulls would need extra momentum to target the 136.64 resistance (3 December 2021, 10 March 2022 and 12 April 2022 highs). A further break of this level gives the bills access to a harvest point at 143.94 (31 December 2021 and 22 March 2022 highs) before 149.72 comes into the picture. Additional upside targets at 154.78 (1 March and 22 April highs) and 167.54 remain far off.

Conversely, this outlook is negated if the bulls fail to achieve a penetration close of 3% above the 124.48 price level. This leaves room for a potential pullback that tests the 110.26 support (7 March low). Additional downside targets reside at 102.68 () and 88.92, where the previous double bottom troughs of 25 September 2021 and 29 October 2021 are found.

IAG: Daily Chart