- Summary:

- IAG share price has continued to perform abysmally in the markets, and in today’s trading session, it is down by 2 per cent.

For the first time since the pandemic started, IAG returned to profitability. However, IAG share price has continued to perform abysmally in the markets, and in today’s trading session, it is down by 2 per cent, extending yesterday’s drop of 2 per cent.

According to the latest financial data, IAG indicated it had made an operating profit of €293m (£245m) between April and June. The second quarter’s profits significantly improved compared to last year when the company lost €967m.

However, despite making substantial profit gains, the company was quick to point out the problems they were currently going through. This includes the constant flight cancellations that total over 10,000 and the continuing labour shortages across the aviation industry. The profits also came despite the soaring inflation and oil prices, which impacted its business model.

During the release of the financial reports, the company also expressed optimism about the upcoming quarter. The expected capacity for the third quarter is 80 per cent of its pre-pandemic level. The company also expects the fourth quarter to have reached 85 per cent of its previous levels.

IAG Share Price

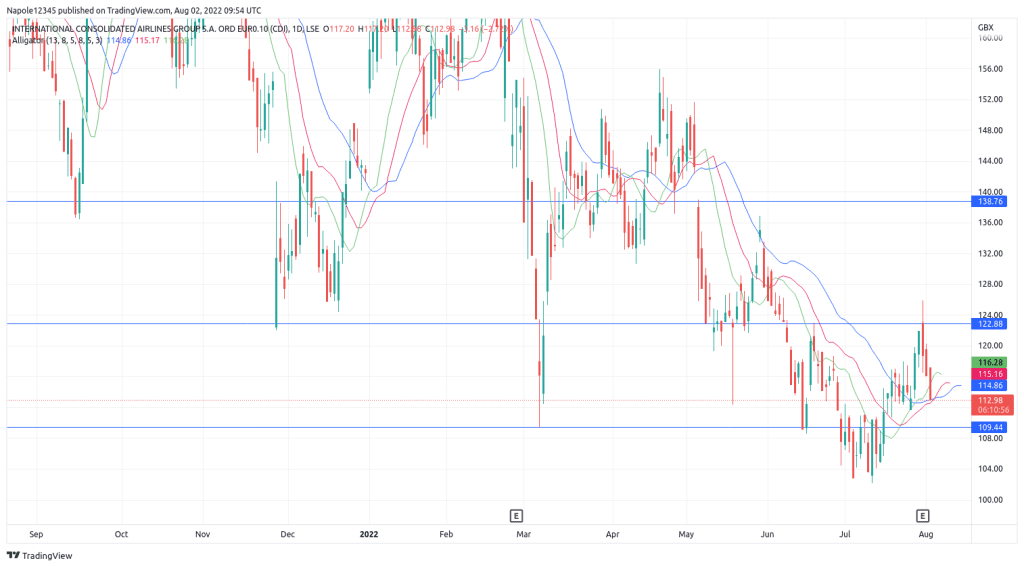

Despite posting solid results last week, the IAG share price has been in an aggressive bearish trend for the past three trading sessions. Today, the share prices are already down by 2 per cent. The trend is also looking aggressively bearish, and since we are still in the early hours of the session, the prices are likely to close lower.

Looking at the chart below, the subsequent few trading sessions are also likely to be aggressively bearish. My IAG share price expectation is for the prices to hit the 109p demand level and possibly trade below the level. For the long-term, a trade below the 100p price level is not out of the picture.

My analysis will, however, be invalidated should the prices reverse and hit the 122p price level. At that point, a bullish trend reversal will be apparent.

IAG Daily Chart