- Summary:

- What is next for the crypto markets and bitcoin in particular according to HYCM's Giles Coghlan, Chief Currency Analyst?

Those of you who have been following the fate of crypto since it topped out last November will be well aware of the pain crypto investors have endured throughout 2022.

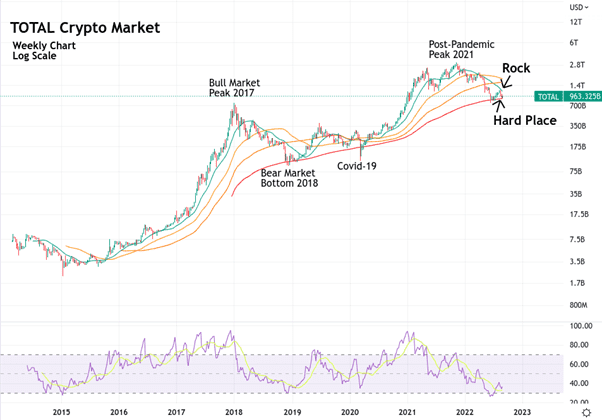

Peak to trough, looking at the aggregated performance of the entire crypto market (TradingView ticker: TOTAL), it lost around 75% of its value between November 2021 and June 2022, with the market currently down around 68% from that November peak.

What’s most concerning about this situation is that cryptocurrency assets do appear to have gone through the bulk of their own bear market and seem as though they may be bottoming out, technically speaking. However, the US equity markets and crypto have been so tightly correlated with since the pandemic, still appear as though they have a further downside in store for investors. Powell’s recent Jackson Hole address doesn’t seem to have helped this perception, and many would argue that that was its purpose.

This begs the question: if crypto is bottoming, but other risk assets aren’t, what will happen to crypto, should those other risk assets experience a next leg down? The answer is that they will probably go down too, which makes the prospect of picking a bottom in crypto somewhat of an onerous task at the moment.

We saw this before the pandemic, when crypto had, again, gone through an entire bear market, shedding close to 90% of its value between December 2017 and December 2018. Then, the first half of 2019 saw crypto rallying to claw back some of its critical levels, only to have the COVID-19 crash send the asset class back down to test lows that were more than a year old at the time.

In the image above, you can see the real rock and hard place that crypto markets are now trading between. As support, you have the 200-week moving average (red line), a level that has historically been the absolute bottom for crypto, as the asset class has never significantly traded below this level.

As a resistance, you have the 20-week moving average (green line). This is another important level for crypto as periods spent above this line usually occur during extended bull markets. For obvious reasons, you probably haven’t heard much about this 20-week MA of late. Crypto markets broke definitively below it in January of this year, then failed to break above it again in April. On the way down, the 20-week MA tends to cap every rally, setting long-term lower-highs as the price descends.

With the most recent failed test of that 20-week MA in August, we have a situation where the price is getting squeezed between these two crucial long-term moving averages as the green line descends towards the red line. This ought to force a break in the coming weeks, but the direction of that break is highly uncertain.

Trade cryptocurrencies, as well as other CFDs and forex currency pairs, with HYCM.