- Summary:

- The HSBC share price is up 1.3% on the day after the bank reported better-than-expected earnings for Q3 2021.

- HSBC share price gains 1.3% on Monday.

- Spike follows better-than-expected Q3 2021 earnings.

- Bank plans a $2billion share buy-back program

The HSBC share price is up this Monday after the bank reported Q3 2021 diluted earnings of $0.17 per share. This figure improves the $0.07 earned in the same period in 2020 and also beats the consensus estimates of $0.11 per share.

Revenue rose from $11.93 billion in Q3 2020 to $12.01 billion in Q3 2021, completing a turnaround from the woeful pandemic-induced performance of the bank in the previous year. The bank also announced it would buy back $2billion worth of shares and indicated it had an upbeat revenue outlook for the rest of the year.

UK bank stocks have recently seen some good demand, as expectations of a Bank of England rate hike drive investors into UK bank stocks. The HSBC share price responded positively to the earnings report and has risen 1.3% on the day.

HSBC Share Price Outlook

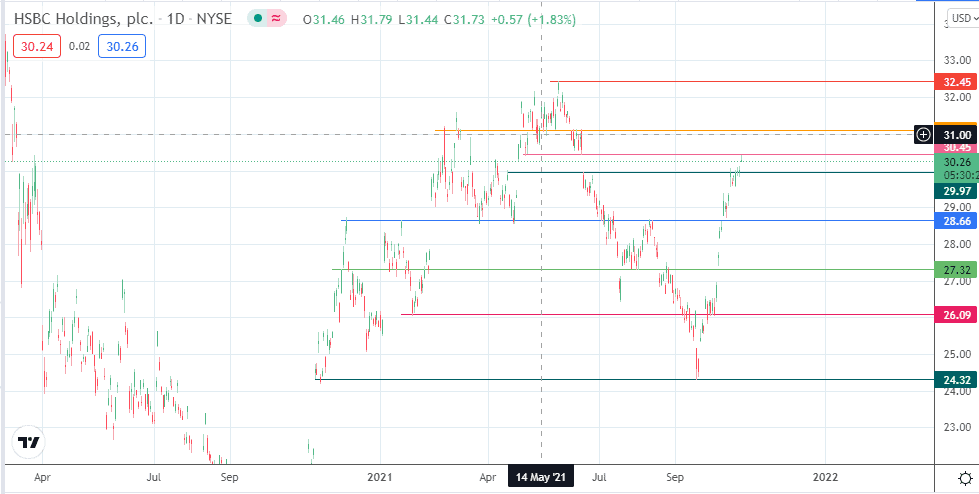

The upside gap of the day takes the HSBC share price clear of the 29.97 resistance. The 4 May/17 June lows at 30.48 may serve as a potential pitstop before 31.10 becomes available as the next resistance barrier. The 2021 high at 32.43 remains the price to beat for bulls.

On the other hand, rejection at 30.45 could spur a pullback towards 29.97, with 28.66 and 27.32 serving as additional targets to the south. 26.09 only becomes available if the corrective decline takes the HSBC share price below 27.32.

HSBC: Daily Chart

Follow Eno on Twitter.