- Summary:

- The HSBC share price soared to the highest level since February 2020 as banking stocks soared. The stock is trading at 538p

The HSBC share price soared to the highest level since February 2020 as banking stocks soared. The stock is trading at 538p on Thursday, a price that is almost 100% above the lowest level in March 2020. This rally has brought its total market capitalization to more than 109 billion pounds.

HSBC latest news

HSBC has made headlines this week. On Wednesday, Reuters reported that the bank’s Mexico unit was considering buying Citibanamex purchase. The terms of the consideration have not been made public but it would be a sign that the bank is expanding its business in the country.

On Thursday, Bloomberg reported that the bank’s new head of global banking and markets was considering cutting its risk-weighted assets by about $100 billion. This is part of the bank’s strategy to retreat from competing with American pees like JP Morgan and Morgan Stanley. The company also wants to grow its debt financing business and expand its Asian segment.

The HSBC share price also popped as investors reflected to the strong results by Deutsche Bank. The bank published strong results but warned about the rising costs. HSBC will publish its results on February 23rd.

Another catalyst for the stock was the hawkish Federal Reserve decision. The bank expects to implement several rate hikes this year.

HSBC share price forecast

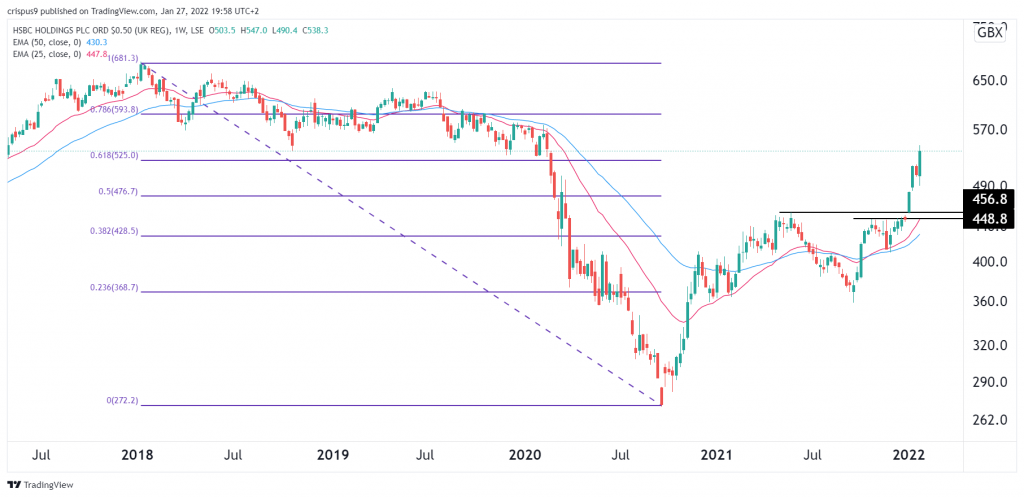

The weekly chart shows that the HSBC share price has been in a strong bullish trend in the past few months. The stock has managed to move above the 61.8% Fibonacci retracement level. It has also jumped above the 25-day and 50-day moving averages. Most notably, the stock has moved above the key resistance at 516p, where it struggled moving above.

Therefore, the stock will likely keep rising as bulls target the next key resistance level at 600p. This view will be invalidated if the stock moves below the support at 470p.