- Summary:

- The HSBC share price is hovering near an important resistance level as investors reflect on the year that was.

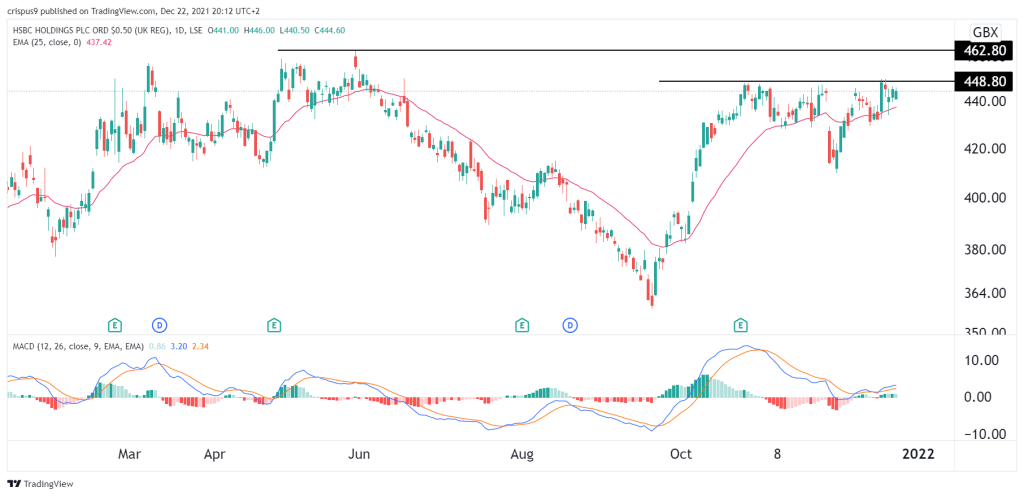

The HSBC share price is hovering near an important resistance level as investors reflect on the year that was. The stock is trading at 444.60p, which is slightly below the key resistance level at 448p. It has risen by more than 8.35% from the lowest level on November 30th.

HSBC is a leading global banking organization that has operations in Europe, Asia, and North America. The company generates most of its income in Asia followed by Europe. In 2021, the stock had a mixed performance. After rising to a high of 463p in May, the stock crashed by more than 22% and fell to a low of 358p in September. Since then, the stock has bounced back by more than 24%.

This performance is attributed to several factors. For one, Asia, its fastest-growing market is going through some weakness as the Chinese real estate industry implodes. Several property companies like Evergrande and Kaisa failed to pay their debts.

At the same time, the Chinese government launched a common prosperity program that sought to address income inequality. As such, there are concerns that the company’s wealth management business will struggle. Most importantly, China launched a crackdown on tech firms that eroded billions in value.

On a positive side, the company managed to sell its French and US operations that were perenially unprofitable. It also continued with its cost cuts while there are signs that interest rates will keep rising. This explains why the HSBC share price has done well recently.

HSBC share price forecast

A closer look at the HSBC stock price shows that it is slightly below the key resistance level at 448p. This is a notable level since it struggled moving above it several times before. It is also above the 25-day and 50-day moving averages while the MACD is above the neutral level.

Therefore, at this point, there are signs that the HSBC share price is on the cusp of a bullish breakout. This view will be confirmed if the price moves above the key resistance at 448p. A move above this level will see it rise to the YTD high of 463p.

However, this pattern can also be said to be a double-top, meaning that a bearish breakout cannot be ruled out.