- Summary:

- HSBC share price pulled back as disagreements between the company’s management and the biggest shareholder continued.

HSBC share price pulled back as disagreements between the company’s management and the biggest shareholder continued. The stock slipped to a low of 523p in London, which was lower than this week’s high of 566p. The shares have also slipped because of the struggling China real estate industry and broad economy.

HSBC is fighting multiple battles

HSBC is one of the biggest banking groups in the world with trillions in assets. The company has vast operations in the UK and Asia. In the past few months, investors have focused on the ongoing disagreement between the firm’s management and Ping An, the biggest investor.

Ping An has argued that the company should separate its business into two. One division will focus on the Chinese and other Asian markets while the other one will focus on western countries. The insurance giant argues that separating the two will lead to more shareholder value.

On paper, this recommendation seems right. Besides, operating in China and Europe is a dramatically different scenario now that geopolitical risks are rising. However, the company’s management believes that the breakup will be much more difficult to carry out.

HSBC share price has also slipped because of the challenging China and Hong Kong property market. Recently, most big developers like Evergrande and Country Garden have come under intense pressure as people stopped paying their mortgages.

HSBC’s growth has also retreated recently. Early this month, the company said that its reported profit after tax rose slightly to $9.2 billion as its revenue dropped to $25.2 billion. Its common equity tier 1 ratio also dipped to 13.6%.

HSBC share price forecast

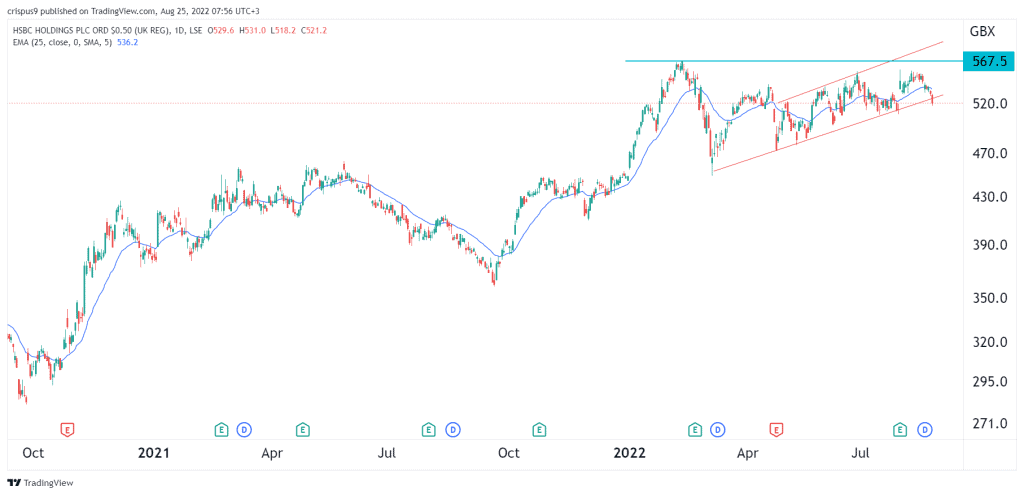

The daily chart shows that the HSBC stock price has been in a strong bullish trend in the past few months. It rose from a low of 282.7p in October 2020 to a high of 567.5p. Recently, the shares formed an ascending channel pattern that is shown in red. It has also managed to move below the lower side of this channel and move below the 25-day and 50-day moving averages.

Therefore, the HSBC share price will likely continue falling as sellers target the key support level at 500p. A move above the resistance point at 542p will invalidate the bearish view.