- Summary:

- The GBPUSD is trading slightly higher on the day, as the markets continue to respond positively to the BoE Governor's comments on negative rates.

The GBPUSD pair extended its bullish move on Wednesday after the BoE Governor Andrew Bailey threw cold water on the possibility of negative rates.

Also driving the Pound is the optimism that has greeted the mass coronavirus vaccinations in the United Kingdom, as the government hopes to stem the ongoing community transmission. Market players are cautiously optimistic that the coronavirus vaccinations could be the factor needed to lift the lockdowns earlier than the proposed March 2021 schedule.

The GBPUSD is marginally higher today, with no other fundamental drivers of price at play in the market on the day.

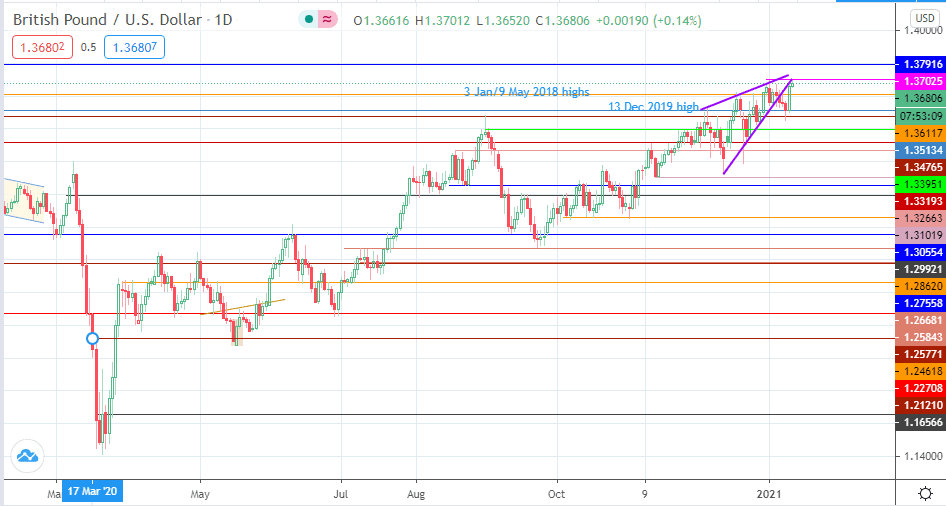

Technical Outlook for GBPUSD

Today’s upside move adds 0.19% to the gains made yesterday on the pair. This move has found resistance at the 1.37025 price level. A break of this level is required for the pair to aim for the 1.37916 high, last seen on 30 April 2018. This move may just be a pullback to the upside, following a downside break of the rising wedge.

On the flip side, a rejection from the current resistance continues the expected downside move from the wedge breakdown and leads to a retest of the 1.36117 price level. Below this area, 1.35134 and 1.34765 are potential targets to the south, as price aims for a measured move to 1.33951.

GBP/USD Daily Chart