- Summary:

- Investors are concerned about the latest impeachment moves, as well as the outlook for the full year earnings season, which commences soon.

The Dow Jones Industrial Average is trailing by 0.33% or 112 points at the time of writing, as investor caution sets into the market ahead of the full-year earnings season. The earnings season looks set to showcase the health of the US economy and the corporate world in a year that many have called a year like no other.

Investors on the Dow Jones Industrial Average were also spooked by the latest attempts at impeaching US President Donald Trump before his term expires in a week. Investors worry that this may create a distraction away from the new administration’s focus on new stimulus.

However, the outlook for the Dow remains bullish, as last Friday’s poor NFP showing may have run new alarm bells for policymakers and the Fed to throw in more stimulus into the mix.

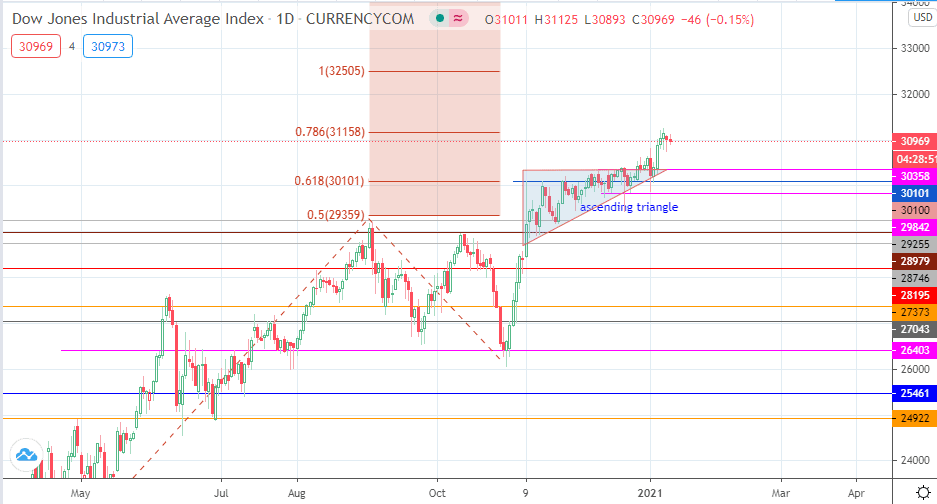

Technical Outlook for Dow Jones

31261 remains the all-time high, which lies just ahead of the 31158 78.6% Fibonacci extension. A further advance in the Dow could allow bulls to target the 32505 price level, which is the 100% Fibonacci extension of the 13 May to 2 September 2020 price swing.

However, extended selling could send the Dow towards 30358, with 30101 and 29842 serving as additional targets to the south if 30358 breaks down.

Dow Jones Daily Chart