- The Darktrace share price popped on Thursday, becoming the best performing company in the FTSE 250 index. What next for the stock?

The Darktrace share price popped on Thursday, becoming the best performing company in the FTSE 250 index. The stock is trading at 947p, which is a few points below its all-time high of 1,000p. This price is also about 78% above its lowest level in August.

Why is DARK soaring?

Darktrace is a fast-growing technology company that offers a complete suite of cybersecurity products to customers from around the world. The company went public in the second quarter of this year and soared. Since then, it has risen by more than 200%, making it one of the best performing London stocks. This rally brings its total market capitalisation to more than £6.47 billion.

The Darktrace share price is soaring today as investors reflect on the company’s forward guidance. In a statement on Wednesday, the company said that it expects its annual growth to rise by between 37% and 39% this year. This was a better outlook compared to the previous guidance of between 35% and 37%. This view was mostly because of a change in foreign exchange headwinds that were not as severe as expected.

The company made a net recurring revenue of $24.1 million in the first quarter of the 2022. This was a strong performance since it was about 63.8% from the same period in 2021. The company expects to add more solutions aimed at customers who have already been attacked. So, what next for the Darktrace share price?

Darktrace share price forecast

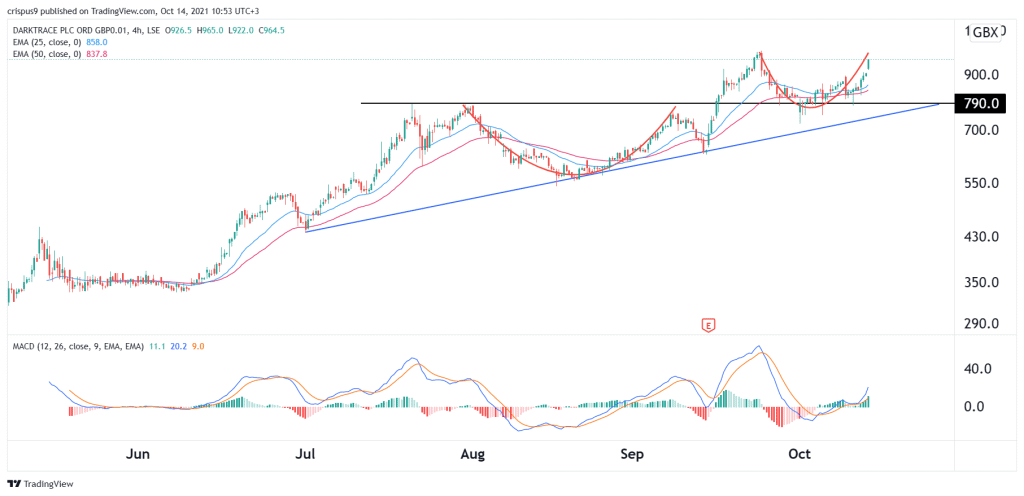

The four-hour chart shows that the Darktrace share price has been in a strong rebound in the past few weeks. The stock first completed the formation of a cup and handle pattern in September. It is now in the process of forming another cup and handle pattern that is shown in green. In price action analysis, a cup and handle pattern is usually a bullish signal.

The bullish trend is also being supported by the 25-day and 50-day moving averages. Therefore, the path of the least resistance for the stock is to the upside, with the next key level to watch being above 1,000p. This view will be invalidated if the price drops below 900p.