- The Lloyds Bank share price is still in a consolidation phase as investors focus on the state of the UK economy.

The Lloyds Bank share price is still in a consolidation phase as investors focus on the state of the UK economy. LLOY stock is trading at 43.40p, which is slightly above last week’s low of 42p. However, this price is substantially below the year-to-date high of 58p. Still, the stock has outperformed the closely watched KBE ETF that tracks the banking sector.

LLOY is still in a bear market

Lloyds and other global banking companies have been in a strong bearish trend this year despite the positive actions by central banks. This is because most central banks, including the Bank of England, Swiss National Bank, and the Federal Reserve, have embraced the most hawkish stance in years. This month, the Fed hiked by 0.75% while the BOE made its fifth rate hike since December last year.

In most cases, banks tend to do well when interest rates rise since they hold billions of dollars in assets they can use. At the same time, they can easily adjust their rates on mortgages and other products. Indeed, mortgage rates in the UK have been in a strong upward trend due to the BOE rate hike.

Lloyds Bank will benefit with the rising interest rates since it is the biggest mortgage lender in the UK. However, the challenge for the bank is that recent data show that the country’s inflation is surging while retail spending has dropped. Inflation has jumped to a multi-decade high of 9.1%, while retail sales have slowed. Similarly, there are signs that the property market is cooling.

Another concern for LLoyds is that it is experiencing wage inflation. Earlier this month, the company announced that it was handing its employees 1,000 pounds to deal with the rising inflation. Unfortunately, this trend could continue and affect its margins.

Lloyds Bank share price forecast

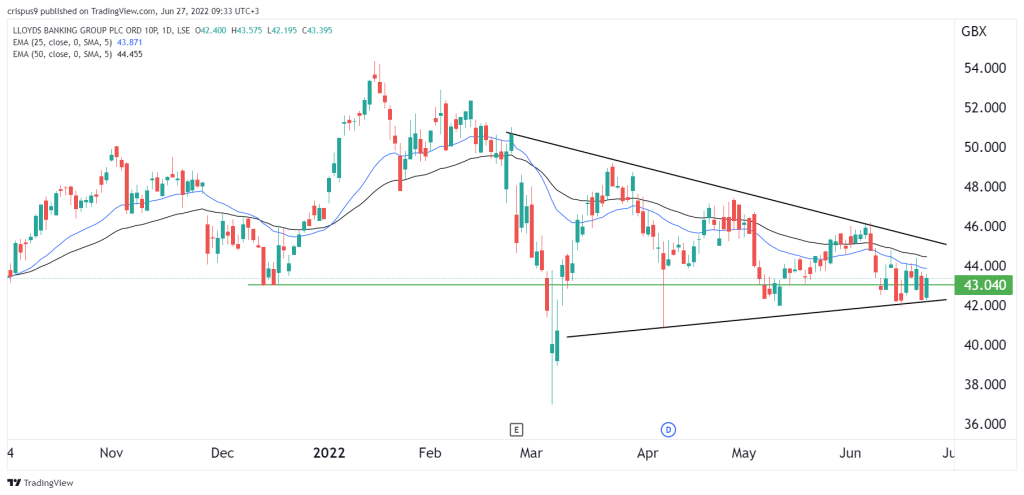

In my last note on the Lloyds share price, I noted that the bank was forming a symmetrical triangle pattern. This pattern is still forming as the company’s stock consolidates. The shares are slightly below the 25-day and 50-day moving averages. They are also slightly above the important level at 43p, which was the lowest point in December last year.

Therefore, at this point, there is a blurry vision about the LLOY share price since the triangle pattern is still forming. While it is hard to predict, the stock will likely have a bearish breakout unless bulls push it above the two moving averages.