- Summary:

- The Robinhood share price has received a huge boost and is up heavily in premarket trading as Sam Bankman-Fried purchases 7.6% equity.

The Robinhood share price has surged this Friday in premarket trading after reports that a Hong Kong-based crypto exchange has struck a deal to purchase a 7.6% equity in the company.

According to a Securities and Exchange Commission (SEC) regulatory filing, Sam Bankman-Fried, the CEO and Founder of cryptocurrency exchange FTX, has purchased a 7.6% stake in the shares trading platform in a deal worth $648.3m. This acquisition was made using Emergent Fidelity Technologies, a company in which Bankman-Fried is the sole director and majority shareholder. The agreement confers on Bankman-Fried ownership of 56.3 million shares.

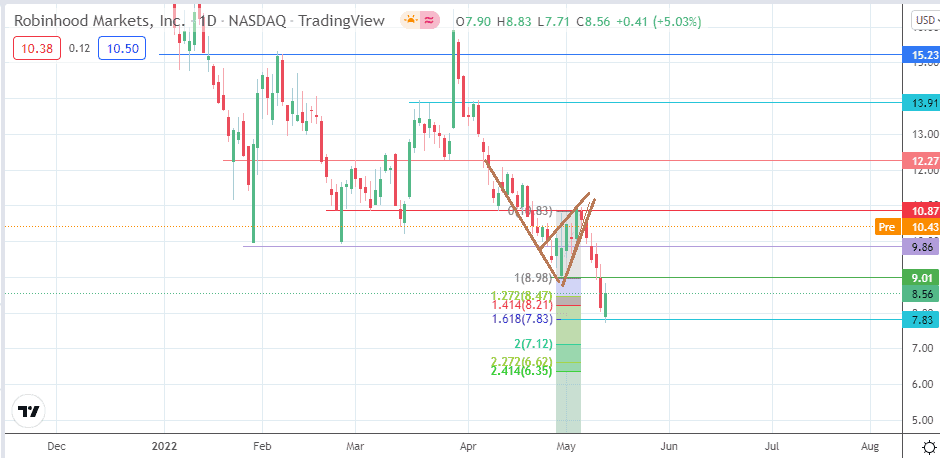

The Robinhood share price is up 5.03% as of writing, following the bounce on the price floor after the completion of the bearish pennant. The Robinhood share price has been on a steady decline since the WallStreetBets saga of early 2021. Investors would be watching to see if Bankman-Fried can bring to play the same magic he did with FTX.

Robinhood Share Price Outlook

The conclusion of the bearish pennant and the bounce on the 7.83 price mark (161.8% Fibonacci extension level) has marked this support as a new bottom. The premarket price activity has broken the 9.01 resistance and the 9.86 barrier (10 May 2022 high).

This action puts the price activity on course to challenge the 4 May 2022 high at 10.87. A successful break of this resistance barrier gives the bulls clear skies to aim for the 1 March 2022 high at 12.27. 13.91 (18 March and 5 April highs) and 15.23 (7 February 2022 high) form additional northbound targets.

Conversely, rejection of the advance at 10.87 could provide for a potential pullback, targeting 9.86 as an initial downside target. If the bulls fail to defend this support, a decline towards 9.01 cannot be ruled out. Other targets to the downside include the 8.55 price mark (127.2% Fibonacci extension level) and the 7.83 all-time low.

Robinhood: Daily Chart