- Summary:

- FTSE 100 loses ground and looks set to close the week lower, after stocks linked to risky assets took a beating on Friday.

The FTSE 100 is down quite a bit this Friday, failing to gather any momentum from the additional stimulus announced by incoming US President Joe Biden. Oil, mining and banking stocks dominate the FTSE 100, and with crude oil prices falling and banking stocks generally hit on the day by the FCA’s no-repossession notices on homes, the index has fallen by three-quarter of a percent as at the time of writing.

The coronavirus situation in the UK continues to be a source of worry for investors. Despite vaccinations being tabbed to double to 500K a day in the UK as from next week, the virus continues to spread and it is feared that as many as one-third of Londoners may already have had the infection. However, the FTSE 100 may also have to contend with new amendments to labour laws in the UK which govern overtime pay, rest breaks, and the number of hours that will constitute a working week.

Technical Levels to Watch

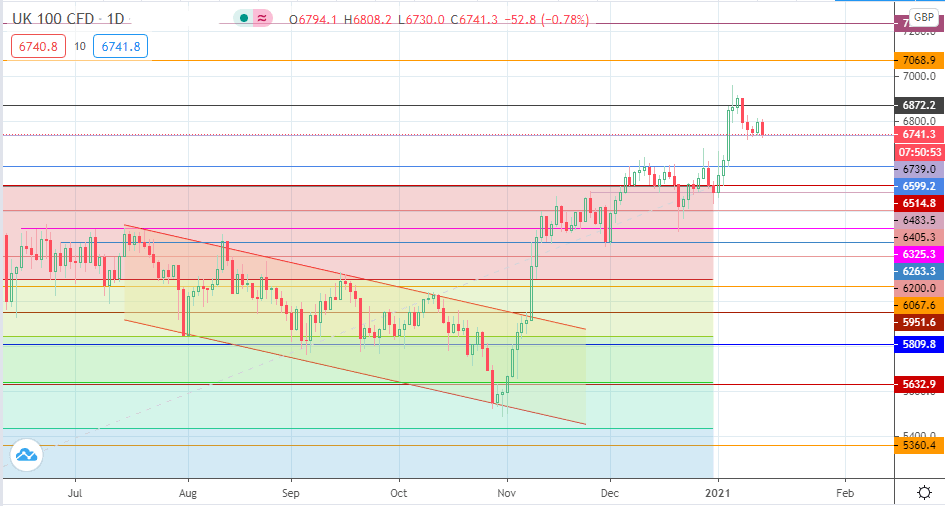

Today’s drop has met support at 6739.0. This is the same support that has held all week long. A breakdown of this support level opens the door for the FTSE 100 to aim for the 6599.2 support. Below this area, 6483.5 and 6405.3 remain relevant targets to the downside.

On the flip side, a bounce from the current support is required to pare all this week’s losses. This will allow bulls to target 6872.2 once more, with 7068.9 and 7232.7 lining up as additional targets to the north.

FTSE 100 Daily Chart