- Summary:

- This write-up details the potential BNGO stock forecasts ahead of Thursday's first quarter 2022 earnings call.

The latest BNGO stock forecast indicates that price action may cool off as investors await the conference call and live webcast that will feature the earnings results for the first quarter of 2022.

The financial results of Bionano Genomics is due for reporting on Thursday, 5 May 2022, at 4.30 pm EST. This makes the release time an after-hours release, with the first reactions to the earnings results expected on Friday. The Non-Farm Payrolls report may likely take centre stage on that day, but the earnings report could provide figures that investors can act on.

The company is coming off renewed investor interest due to the issuance of two patents for novel methods that expand existing patent protection for using nanochannel arrays in genomic analysis. This has resulted in three days of gains on the stock, with the BNGO stock price rising 0.29% on the day. However, the bullish momentum on the stock appears to have waned as the price activity approaches the 1.84 resistance mark. The BNGO stock price forecast showcases potential plays ahead of Thursday’s earnings call.

BNGO Stock Price Forecast

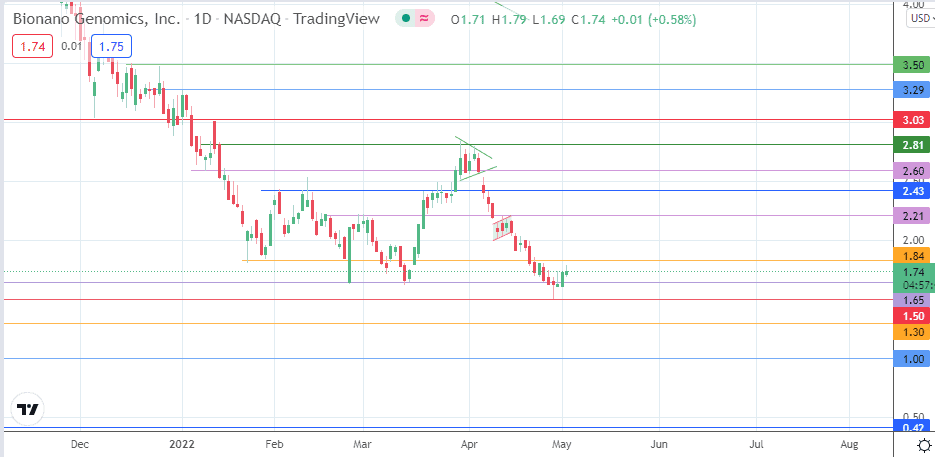

The active daily candle appears to be on its way to the 1.84 resistance mark (28 January and 23 February lows). If the price advance removes this barrier, the 2.21 price resistance shows up as the next target, the site of previous highs last seen on 1 March and 12 April 2022. 2.43 (2 February high) and 2.60 (14 January and 29 March highs) are additional targets to the north, as are 2.81 and 3.03 (12 January high). A breach of the latter makes a case for a trend reversal.

Conversely, an opportunity to sell on rallies appears if there is a price rejection at the mentioned resistance barriers. Ultimately, the bears would initially seek a breakdown of the 1.65 support level, targeting 1.50 (4 December 2019 high and 28 April 2022 low). Then, a continued decline would bring in additional support targets at 1.30 (5 December 2019 and 7 January 2020 highs) and at 1.00 (6 September 2019 and 3 February 2020 lows).

BNGO: Daily Chart

Follow Eno on Twitter.