- Summary:

- What is the outlook of the HCMC stock price? We explain why this penny stock is not worth your time as an investment.

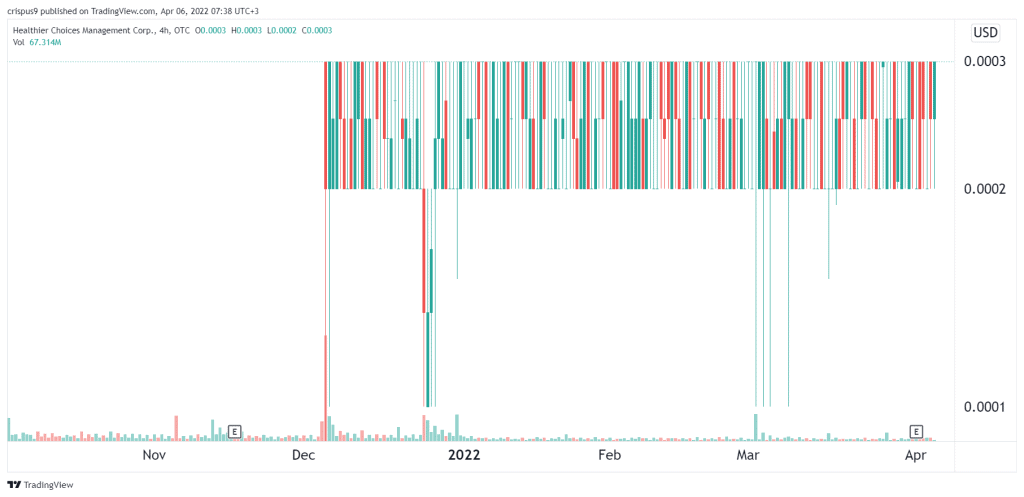

The HCMC stock price has been dead water for a while now. The shares have remained in the same range in the past few months, making it an unworthy holding for both investors and traders. It has crashed by more than 90% in the past 12 months, making it a top underperformer. Its market cap has fallen to just $67 million.

Healthier Choices Management is a small company that focuses on a number of services in the wellness industry. It operates Healthy Choice Markets that operate Ada’s, Natural Market. This is an 18,000 sq ft grocery store. It also owns Greenleaf Grill, a wellness centre, and a vitamin shop. In the latter segment, the firm sells some leading brands like New Chapter and Every Man Jack among others.

HCMC published its results recently. The management said that the company ended the year with about $28.8 million in current assets, which was higher than the previous $3 million. Its current liabilities stands at $2.5 million. This means that the company has a networking capital of about $29 million. In finance, WC is calculated by subtracting current liabilities from current assets.

Meanwhile, its sales from operations were $13.3 million, which was lower than the previous year’s $13.9 million. The management attributed this decline to the shutting down of its vape stores. As a result, the company had a net loss of $4 million. So, is HCMC a good investment?

HCMC stock price forecast

HCMC is a penny stock, meaning that it is only a good option among day traders. Historically, these stocks are usually volatile and not followed by Wall Street investors. In fact, looking at the HCMC stock price shows that it has barely moved in the past few months. Therefore, it would be difficult to recommend the stock considering that it also does not have any meaningful volume.