- Summary:

- The Hang Seng index looks to continue its bullish move as it responds positively to the shares repurchase increase by Alibaba.

The rebound in tech companies trading in Hong Kong has impacted the Hang Seng index robustly bullishly. The Hang Seng index was able to gain 1.21% on Wednesday, complementing the previous day’s 3.15% blowout as Chinese tech companies performed superbly on the back of the supporting statements made by the Chinese government last week.

Recall that last week, the Chinese government issued a policy statement in which it made a promise to support any Chinese firms which wanted to list on foreign exchanges. A pledge to ease tech sector regulation in China was seen as a 180-degree turn from the position the government assumed in November 2019 following a critical speech made by Alibaba’s Jack Ma.

The Hang Seng index posted a combined 14% gain in the two days following the Chinese state council’s statement. This allowed the index to rebound strongly after the hefty fall suffered in the first half of the month. The announcement by Alibaba that it was increasing the size of its shares buyback program was mainly responsible for Tuesday’s rally in the Hang Seng index. Alibaba said it would increase its share repurchases from $15 billion to $25 billion.

Hang Seng Index Outlook

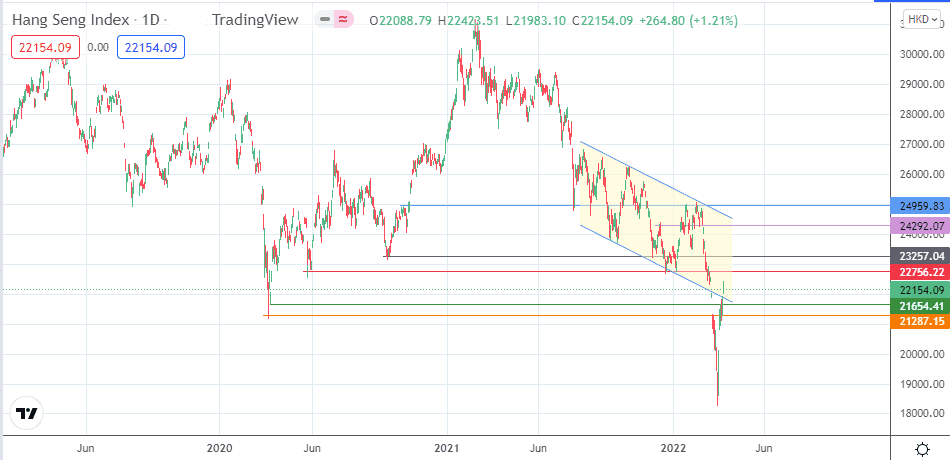

A break of the 21654.41 resistance and the channel’s lower border opens the door for a push towards 22756.22 initially, before 23257.04 enters the mix as an additional price target to the north. On the other hand, the bears need to force a decline below 21654.41 to bring 21287.15 into the mix as an initial downside target. Other potential targets exist at 20,000 (psychological support and 9 March 2022 low) and the 15 March low at 18235.48.

Hang Seng: Daily Chart