- Summary:

- The Hang Seng index rally paused this week amid rising concerns about lockdowns in China. It was trading at $17,720

The Hang Seng index rally paused this week amid rising concerns about lockdowns in China. It was trading at $17,720, which was slightly lower than this month’s high of $18,438. This price is about 20% above the lowest level this month. It has fallen by almost 45% from its lowest point in 2021.

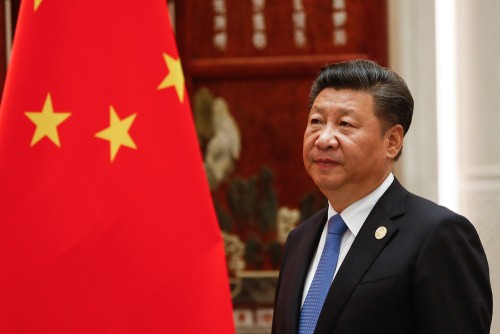

China lockdowns hurt Hong Kong stocks

The Hang Seng index has pulled back as concerns about China remains. According to the Financial Times, Covid-19 cases in the country have rallied to the highest level on record. As a result, officials have decided to lock down large swaths of the country, including in Guangzhou and Beijing.

These lockdowns have disrupted global supply and the Chinese economy in particular. As a result, the Chinese economic growth is expected to lag that of most south Asian countries for the first time in decades. The manufacturing and services sectors have also underperformed because of these lockdowns. Data by the National Bureau of Statistics showed that the lockdowns dragged Shanghai’s growth to 0.4% in Q2.

The Hang Seng index is highly sensitive to activities in mainland China since most companies have a large exposure in the country. For example, companies like Sands China, Budweiser, China Resources Beer, and China Petroleum make most of their money in the mainland.

Still, most Hang Seng constituents have done well in the past 30 days. Country Garden Holdings an Cuntry Garden Services have risen by 100% in this period. Technology companies like Alibaba, Tencent, and JD.com have rallied by over 40%.

Other top performers in the Hang Seng are HKEX, AIA Group, Ping An Insurance, and Budweiser. The only stocks in the red are BYD, WH Group, New World, and China Shenhua Energy.

The Hang Seng is still a good buy for the brave. Its constituent companies are significantly undervalued than other indices and there is a likelihood that China will move back to growth in 2023.

Hang Seng forecast

The four-hour chart shows that the Hang Seng index has been in a strong bullish trend in the past few days. It has rallied from a low of $14,618 to over $18,000. The index managed to move above the 25-day and 50-day moving averages. It has also rallied above the 38.2% Fibonacci Retracement level. The index is also above the Ichimoku cloud.

Therefore, the Hang Seng will likely continue rising as buyers target the next key resistance at $20,000, which is above 13% above the current level. A drop below the support at $17,200 will invalidate the bullish view.