- Summary:

- The Hang Seng index sheds weight for a 4th day in a row after domestic earnings and fears of future rate hikes hurt sentiment.

The Hang Seng index closed the session marginally low in another day of low volume trading on the Hong Kong stock exchange. The 0.14% drop marked the fourth straight losing session, as headwinds from China and the expectations of further tightening by the Federal Reserve continued to exert pressure on the index.

The Hang Seng index fell to three-month lows last week following uninspiring corporate earnings from the domestic scene. China’s largest developer, Country Garden, reported a 96% profit drop, sending the Hang Seng tumbling. This profit drop exposed the turmoil in the Chinese property market, which has failed to recover from the Evergrande saga. The energy crisis being witnessed in the country has also soured the sentiment on Hong Kong stocks.

However, hopes that Chinese policymakers may step in with some support measures for the economy have helped to cap losses on the Hang Seng index, which currently trades a little higher than the 19800 support level.

Hang Seng Index Forecast

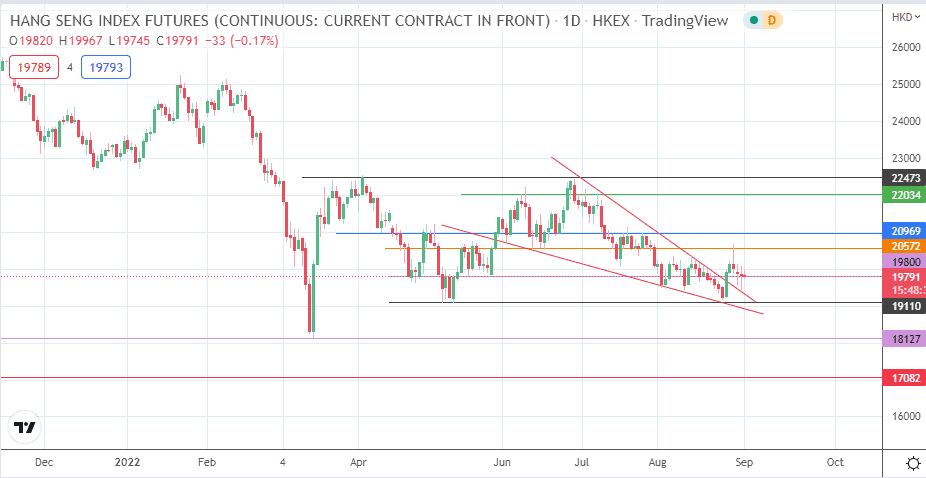

The break of the falling wedge by the 25 August candle met resistance at 20572 (14 June and 21 July lows) before pulling back to the 19800 support in a return move. The bulls need to force a bounce on this pivot to send the pair toward the 20572 mark once more. The completion of the measured move at 20969 (30 May and 27 July highs) requires a break of 20572. A continuation of the advance sends the asset toward the 22034 resistance (9 June and 8 July highs). 22473 awaits the bulls if the bears cannot stop the advance at 22034.

On the flip side, a breakdown of the 19800 support makes the 19110 pivot available, being the site of prior lows of 13 May and 24 August 2022. Below this level, the 15 February 2016 and 16 March 2022 lows at 18127 become the next downside target. Multi-year lows are found at 17082, where the 26 September 2011 low is found.

Hang Seng: Daily Chart