- The Hang Seng index had a relatively successful performance in May as it rose by over 2%. We explain why the HSI will rise to 22,000

The Hang Seng index had a relatively successful performance in May as it rose by over 2%. It recovered by about 10% from its lowest level during the month and is currently hovering near its highest level since April 26th this year. This performance was mostly driven by the earnings season that happened in May and the Hong Kong election.

HSI May review

The Hang Seng index staged a strong recovery in May this year after the positive quarterly results by companies like Alibaba and HSBC. Alibaba said that it had a nice quarter and boosted its forward guidance. As a result, the Alibaba stock price managed to jump by about 15% in the final week of the month. Other tech stocks like Tencent, JD, and Meituan recovered slightly after signs emerged that China was planning to ease regulations.

HSBC was another top mover in May. In total, the HSBC share price rose by almost 10% after the company published strong results. A key catalyst for the company was that Ping An, one of the company’s top shareholders, advocated for breaking up the company. The idea is that breaking the Asian and European business will create value for shareholders.

Looking ahead, June will likely be a positive month for Hang Seng since China is expected to end most of the ongoing lockdowns. At the same time, since there will be no major earnings during the month, investors will focus on broader issues such as interest rates. The top Hang Seng stocks to watch in June will be AIA Group, Geely Automotive, Tencent, Sands, and Ping An.

Hang Seng forecast

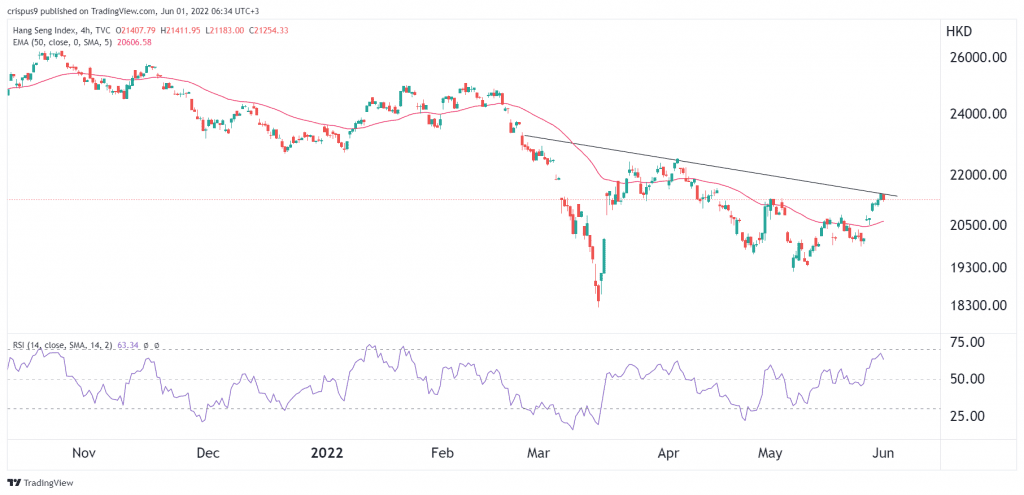

The four-hour chart shows that the Hang Seng index has been in a strong bullish trend in the past few days. It is now trading at H$21,270, which is much higher than the lowest point in May this year. The stock has moved above the 25-day moving average while the Relative Strength Index (RSI) is approaching the overbought point at 70.

Notably, the index has retested the descending trendline shown in black. Therefore, a move above this resistance will be a signal that bulls have prevailed, with the next key level to watch being at H$22,000. On the flip side, a drop below the support at H$21,200 will invalidate the bullish view.