- Summary:

- Will the GSK share price tilt towards a deeper correction, or will bullish sentiment around a new vaccine development head push price?

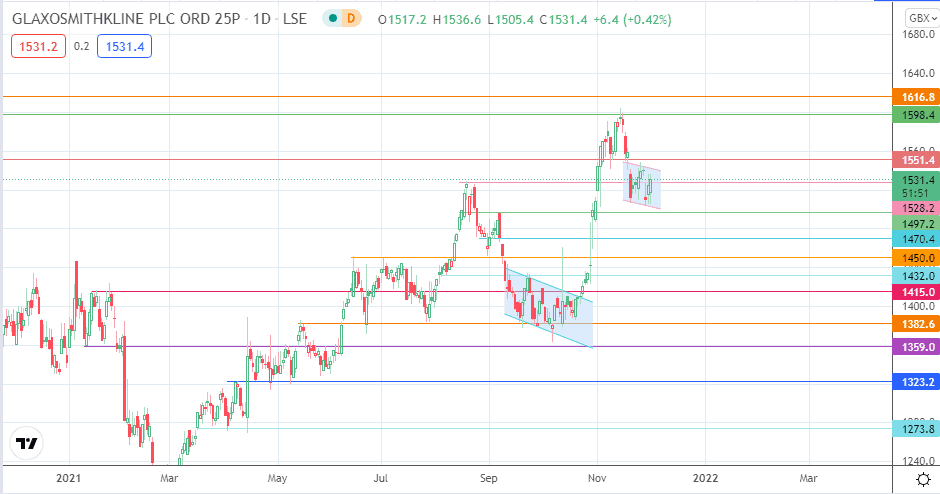

The odds for a near-term correction in the GSK share price have heightened due to the inability of price action to breach a particular resistance barrier for three straight sessions. This scenario has arisen despite the GSK share price adding 0.59% on the day.

The intraday rise comes as GSK poached one of the scientists behind the Pfizer COVID-19 vaccine, Phil Dormitzer, as its new Global Head of Research and Development of Vaccines. Dormitzer is to commence duties on 3 December, and the move is expected to hasten GSK’s search for a vaccine candidate.

The daily chart of the stock shows a developing bearish flag, which points towards a deeper correction. Market watchers would be watching to see if bullish sentiment around Dormitzer’s appointment overwhelms the picture on the chart.

GSK Share Price Outlook

The price action is testing the resistance at 1528.2. If it breaks this level, the flag’s upper edge comes into view. If the bulls break this border, the flag is invalidated, and the door opens towards 1551.4. 1598.4 remains the 2021 YTD high to beat.

On the flip side, rejection at 1528.2 puts the lower edge of the consolidation area under pressure. If this border breaks down, the pattern is confirmed, and the corrective decline towards 1470.4 and 1450.0 would commence. There is a potential pitstop at 1497.2.

GSK: Daily Chart

Follow Eno on Twitter.