- Summary:

- What is the outlook of the Greggs share price? We explain why it has sold off lately and whether it is now in a buy level.

The Greggs share price downward momentum continued this week after the company lamented about the rising cost of doing business. The stock is trading at 2,206p, which is about 37% below its highest point this year, meaning that it is in bear territory. The current price is the lowest it has been since April 2021.

Greggs is a leading bakery chain in the UK with over 2,400 outlets and a market cap of over 2.2 billion pounds. As a result, the company has been directly affected by the ongoing crisis in Ukraine. As a result of sanctions on Russia, the price of wheat has surged to an all-time high. As a result, this will lead to margin compression in the near term.

The company is also seeing a significant increase in labor and logistics costs. This is because most employees are now demanding higher salaries while the cost of transport has risen because of the rising oil prices. In a statement on Tuesday, the firm said that its cost inflation was between 6% and 7%, which is higher than the overall UK average.

Still, the company’s business is benefiting from higher demand. In January, its sales jumped by more than 5.3%. As a result, its pretax profit in the past quarter rose by 34% to 145 million pounds. The firm also announced that it will soon pay a special dividend of 40p per share.

Greggs share price forecast

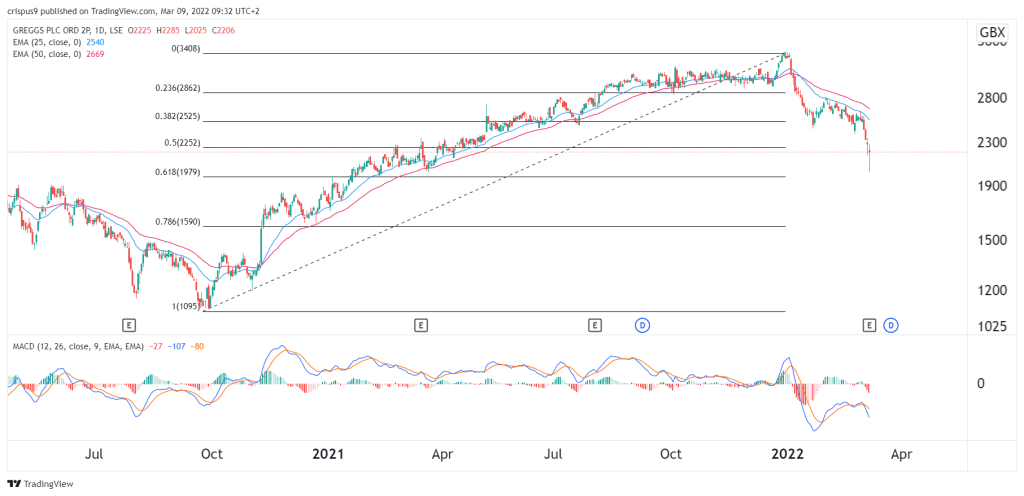

The daily chart shows that the GRG share price has been in a deep downward trend in the past few months. As a result, the stock has moved below the 50% Fibonacci retracement level. The downward trend is being supported by the 25-day and 50-day moving averages, while the MACD has moved below the neutral level.

Therefore, there is a likelihood that the Greggs stock price will continue falling in the near term because of margin compression issues. If this happens, the next key level to watch will be at 1,980p, along with the 61.8% retracement level. However, the stock will rebound in the long-term because of its strong fundamentals.