- Summary:

- Google share price has been in a bearish trend for the past few days. However, the impending share split could append the trend.

Alphabet is on the verge of a stock split, which may impact Google’s share price in the next few trading sessions. While the past few days have been rough for the company, the July 15 stock split may affect its prices, most probably to the upside.

Google’s impending stock split

The bull run last year and the record profits have financially put Google in a strong position for a stock split. The stock split will see the company increase the number of its shares to boost the stock’s liquidity and make it affordable for investors.

Currently trading at $2234, the upcoming Google stock split will not change its market value. However, post stock split, the price of the shares will most likely rise as many investors consider such a move an indication that the company’s unrealized value and growth prospects are high.

The Google stock split also makes sense, following the latest financial reports that showed the company had a 23 per cent year-over-year revenue increase. The March 31, 2022, report also showed the company’s operating income had increased by 22 per cent during the same period to $20.09 billion.

The 2023 GOOGL’s EPS and revenue projections are also positive, with an expected rise of 18.6 per cent and 15.1 per cent, respectively, year-over-year. The financial records show a positive outlook for one of the best-performing companies in the world.

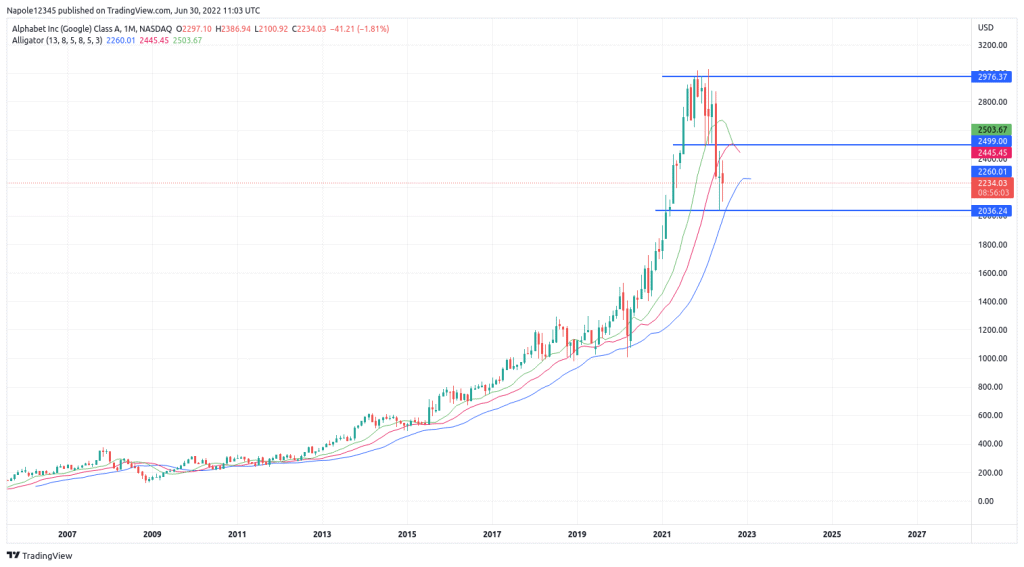

Google Share Price Analysis

Therefore, putting everything together, my Google share price expectation is a strong price surge heading into July 15 stock split. I expect the prices to rise and trade above the recent price high of $2371. There is also a high likelihood that we will see the prices trading above the $25,000 level in the next few weeks.

Even if the Google price share does not respond well to the share split, there is a high likelihood that the drop will be minimal, and the prices will recover and set a new price high in the next few weeks.

Google Daily Chart