- Summary:

- Gold is trading higher after a volatile session which started lower and stopped at the 200 hour moving average at 1,332, but started to rebound

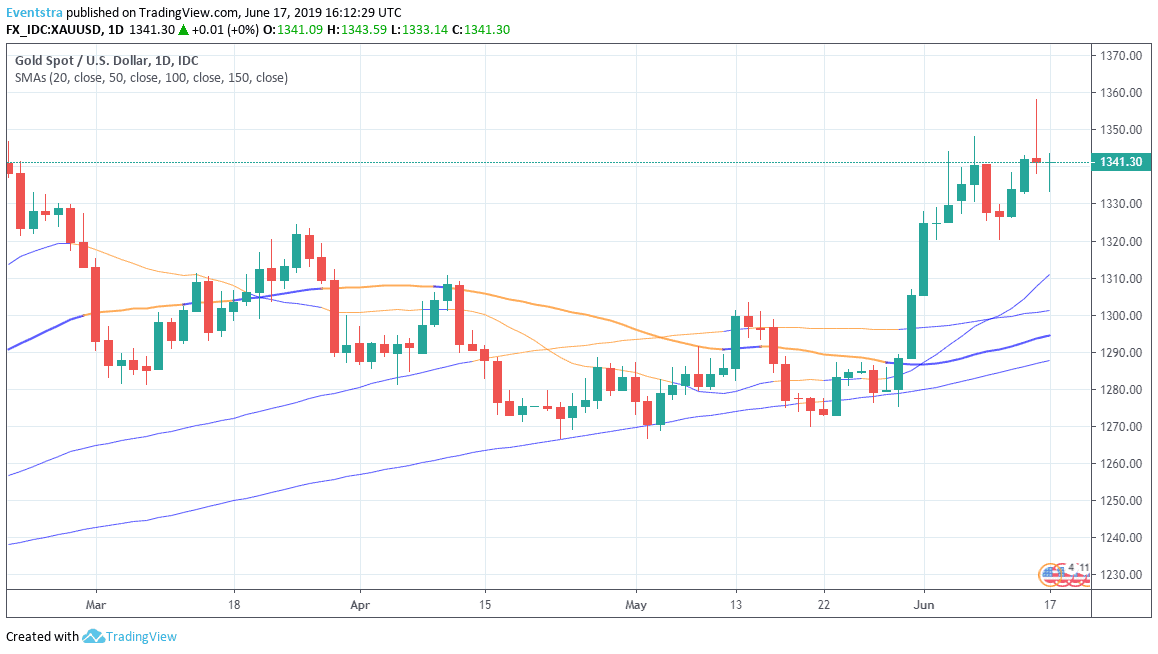

Gold is trading higher after a volatile session which started lower and stopped at the 200 hour moving average at 1,332, but started to rebound during European session and hit the daily high at 1,343.35 at the 50 hour moving average. The precious metal looks trapped between the hourly moving averages in 10 dollars trading range as investors await the FOMC policy meeting. The July futures suggest a 66.6% chance of a cut as inflation slows and the global economy weakens. Earlier today the Empire State Manufacturing Index came in to -8.6 in June marking the lowest level since Oct 2016.

The yellow metal momentum is bullish as it holds above all the major daily moving averages despite the recent correction. The immediate support for the yellow metal stands at $1,328 the low from Thursday that have tested successfully twice, while more solid support can be found at the $1,310 the low from early April. On the upside resistance would be met at 1344 recent high and then at 1,357 the high from Friday. We are bullish on gold and any pullback should consider as a buying opportunity.