- Summary:

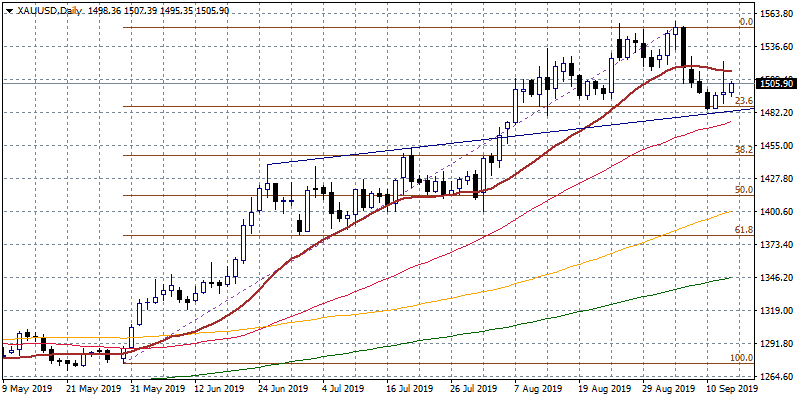

- Gold price rebounds from daily lows below 1,500 mark up to 1,506 area keeping the positive long term outlook. Gold pressures continue

Gold price rebounds from daily lows below 1,500 mark up to 1,506 area keeping the positive long term outlook. Gold pressures continue as US-China trade war tensions ease and the no-deal Brexit scenario gets out of the way. Markets now expecting a 50 bps rate cut at the Federal Reserve policy meeting on September 18th.

The long term bullish momentum for the precious metal holds despite the price is trading below the 20-day moving average for sixth consecutive sessions. Gold found strong support at 23.6% Fibonacci retracement. Immediate support for Gold stands at 1,495 daily low and then at $1,474 the 50-day moving average, a level that the last time the price was below is back in May 2019. On the upside, resistance would be met at 1,507 today’s high and then at 1,516 the 20-hour moving average; more offers will emerge at 1,556 yearly high. The critical point here is the 1,500; long positions can feel safe as long as the precious metal trades above that level.