- Summary:

- On the technical side, bulls are controlling the game as long as the price holds above 1,500. A break below will question the positive momentum

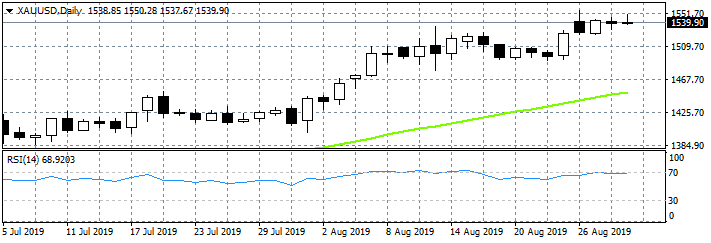

Gold price retreats from daily highs around 1,550.28 down to 1,540 area keeping the positive momentum intact. Gold is getting a hand from the escalation in US-China trade war tensions. Global growth concerns can explain why investors still prefer the safety of yellow metal.

The low for the day is at $1,537 and the high at $1,550 just shy of the 1,555 recent high. The main trend is still bullish and now the short term momentum also shifted to the upside. Gold price holding strong the last weeks despite that markets now having priced out a 50bps rate cut at the Federal Reserve September 18 meeting.

Immediate support for the yellow metal stands at $1,525 the low from August 27th, then at $1,493 low from 23rd August, while more bids will emerge at 1,451 the 50 day moving average. On the upside, resistance would be met at 1,550 today’s high and then at 1,555 the high from August 26th. The RSI is approaching overbought level so a correction lower can’t be ruled out.

On the technical side, bulls are controlling the game as long as the price holds above 1,500. A break below will question the positive momentum, but I will wait for a break below 1,451 to confirm a new leg lower.

Gold Retreats From Daily High, Bulls in Control

Gold Retreats From Daily High, Bulls in Control