- Summary:

- Gold prices are under severe pressure following today’s better than expected U.S. NFP figures, and a slide below $1380.87 might end the bull trend.

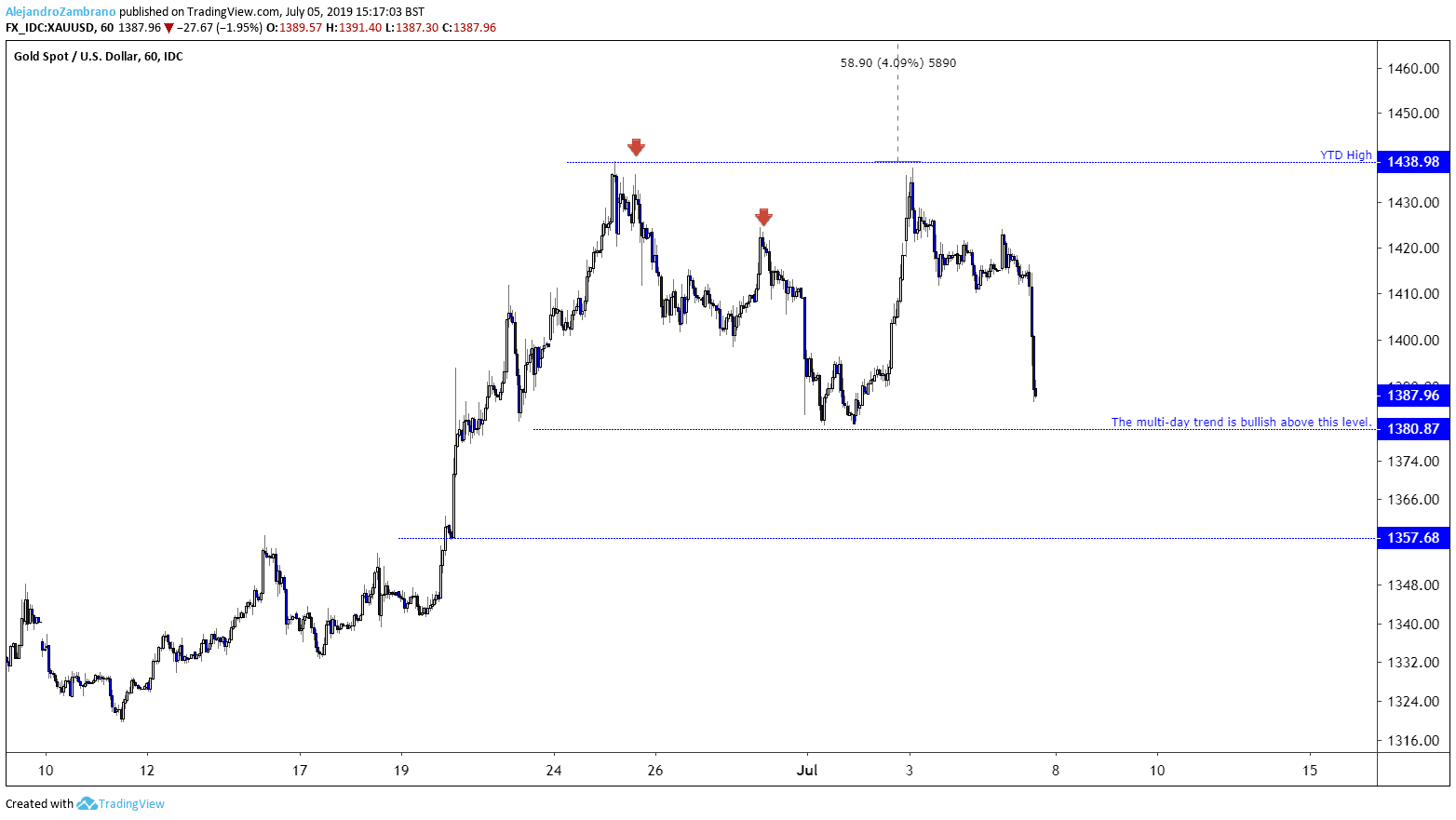

Gold prices are under severe pressure following today’s better than expected U.S. NFP figures. At the time of writing the price was down by 1.95% and trading at $1387.96. The long-term trend was also bullish following the breakout of the 2013-2019 range in late June, but the trend was under pressure. A slide below the July low at $1380.87 could dash hopes of further gains, however, as long as the price would trade above this level, the price would remain short-term range bound between 1380.87 level, and the YTD high of $1438.98.

In the short-term, the price was oversold, and the price was also resting above the July low so a bounce to $1400 level would not surprise me, while a break to the July low would probably open the door for a slide towards June 20 low at $1357.68.

Earlier today, the US NFP showed that the US economy produced 224,000 new jobs and thereby beat expectations of 160,000 new jobs created per a Bloomberg news poll. The NFP outcome has reduced the probability of more than one rate cut by the Fed before the end of the year.

Yesterday, the likelihood of four rate cuts in 2019 was at 19.1%, while today it dropped by more than half to 8% according to CME futures.Don’t miss a beat! Follow us on Twitter.