- Summary:

- Gold price on the XAU/USD chart is up 1.87% after falling US long-term yields and higher inflation drive flows into the yellow metal.

A stronger-than-expected reading for the US Consumer Price Index has spurred a choppy day of trading, which has ultimately ended with gold price shooting towards the $1800 mark.

The headline US CPI number came in at 0.4%, which beat the estimated and the previous number of 0.3%. The Core CPI came in as expected at 0.2%, beating the last number at 0.1%.

The inflation data has spurred comments from several Fed policymakers, who seem unanimous that the tapering of the bond-buying program of the FOMC will start in November. Gold price (XAU/USD) is up 1.87% as of writing, buoyed by falling US long-term yields.

Gold Price (XAU/USD) Outlook

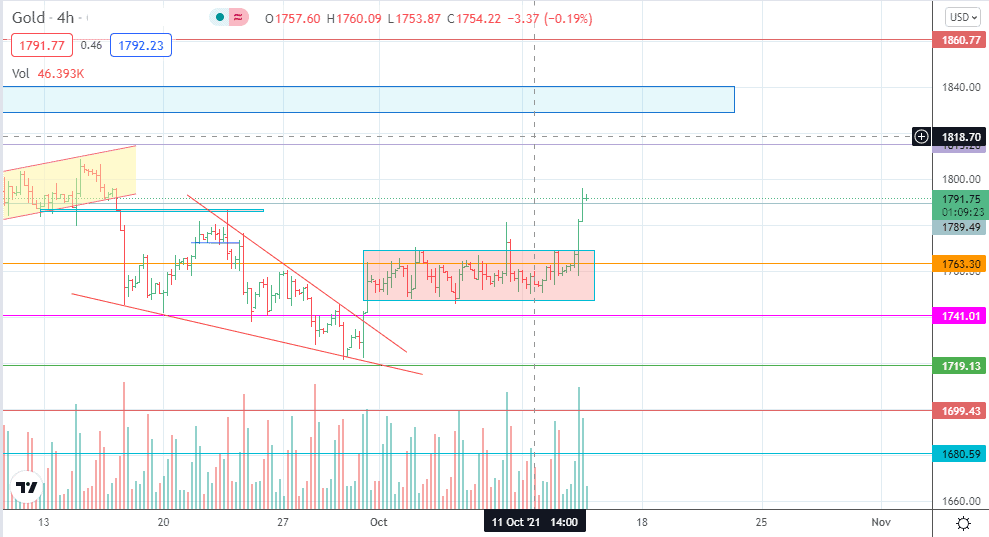

The price action has broken the upper limit of the rectangle pattern, taking out the 1789.49 resistance with an intraday violation. This leaves 1800.00 and 1815.20 as the immediate targets to the north for the bulls.

On the other hand, failure to sustain the violation above 1789.49 could lead to a pullback. Such a move targets 1763.30 and 1741.01 in the near term. Gold price action has rarely strayed above 1815 or below 1699 in recent months, and these boundaries may continue to serve as the limits of price action heading into November’s tapering date.

Gold Price (XAU/USD): Daily Chart

Follow Eno on Twitter.