- Summary:

- Gold price fell steeply in the Asian and London session, as a rise in US bond yields pressurized the XAU/USD pair.

Gold price (XAU/USD) fell steeply on Tuesday, as concerns over China’s Evergrande Group and rising US bond yields set off risk aversion, which favoured the greenback. Also adding to the downward sentiment on gold prices is the expectation that the US Fed Chair Jerome Powell could make comments alluding to an earlier rate hike cycle when he testifies before the US Senate Committee on Banking, Housing, and Urban Affairs.

Gold is a non-yielding metal. Whenever long-term bond yields in the US increase, capital flows into the higher-yielding bond assets. Bond yields have risen for three days straight and are currently posting gains for the fourth day.

Gold Price Outlook

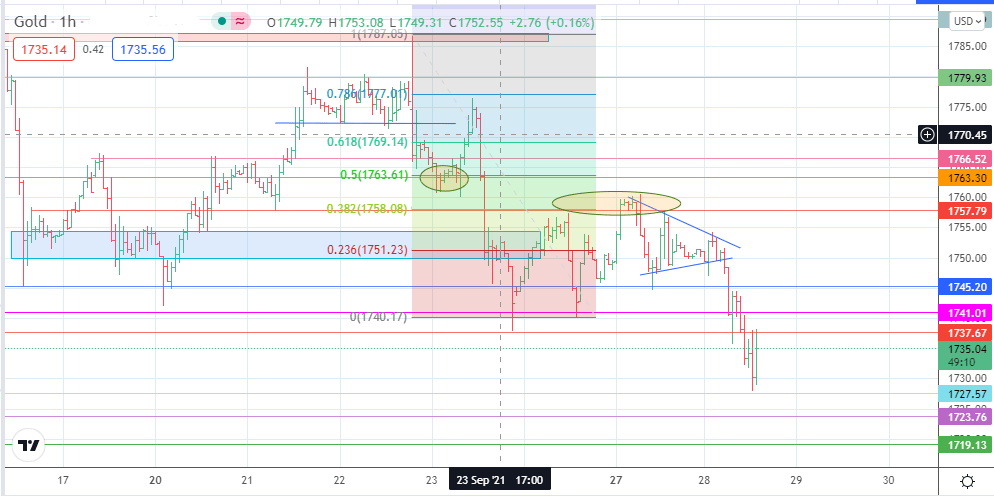

The upside retracement on the XAU/USD pair stalled at the 38.2% Fibonacci retracement level of 1758.08. The ensuing price move formed a symmetrical triangle, with an eventual downside resolution that has led to the intraday slide that found support at 1727.57. This move has taken out support levels at 1741.01 and 1737.67, turning them into potential rally-sell areas.

If the current upside retracement stalls at any of these points, further shorting by the bears could retest 1727.57 before 1723.76 and 1719.13 come into the picture.

On the flip side, a recovery move that takes out 1737.67 extends the retracement towards 1741.01 and 1745.20. Short-term recovery is enhanced if the gold price action rises above 1757.79. This move clears the pathway towards 1763.30 and 1766.52 before clear skies emerge ahead of 1779.93.

1-hour Gold Price (XAU/USD) Chart

Follow Eno on Twitter.