- Summary:

- Gold price (XAU/USD) slumps more than 2% after surprisingly strong retail sales data and a jump in manufacturing activity in Philadelphia.

Providing demand for the greenback this Thursday was the surprisingly strong retail sales data, with showed that the headline and core retail sales numbers for August rose from -1.8% and -1.0% to 0.7% and 1.8%, respectively. Both numbers trumped market estimates which saw the headline number improving to -0.7% and the core number to -0.1%.

Also propping up the dollar was the surprising jump in the Philly Fed Manufacturing Index from 19.4 in the previous month to 30.7 in September. These data overcame whatever disappointment followed the marginal climb in the Initial Jobless Claims, which saw a jump from 312K to 332K in the week ended 10 September.

The extent of the improvement was responsible for the decline in the XAU/USD pair by more than 2.2% before bulls helped pare some of those losses.

Technical levels to watch

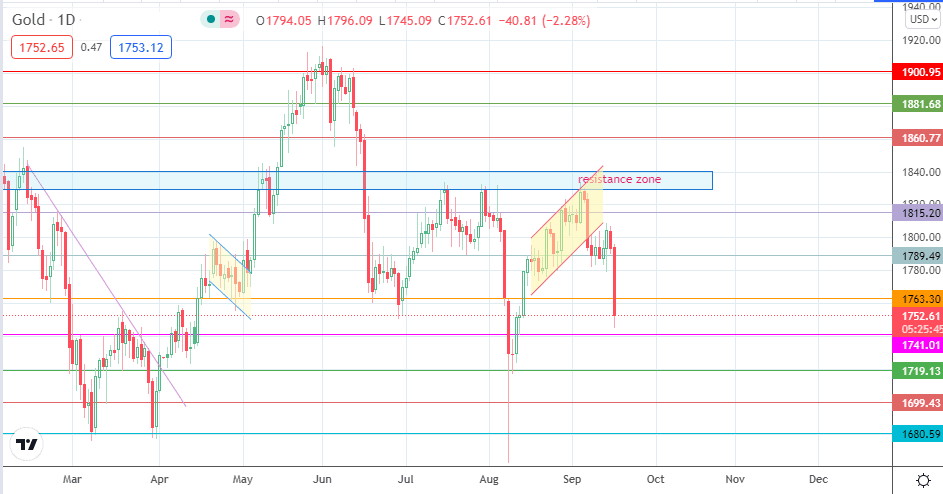

The drop in gold prices has violated the support at 1763.30. However, a 3% penetration close below this level is needed to confirm the breakdown of this pivot. This move opens the door towards 1741.01. 1719.13 (5 April and 10 August lows) is the next support level of note before 1699.43 (12 March low) comes into the picture as an additional price target to the south.

On the other hand, failure to break down 1763.30 may allow a respite for the bulls, with 1789.49 and 1800.00 constituting the primary price barriers to the upside.

Gold Price (XAU/USD) Daily Chart

Follow Eno on Twitter.