- Summary:

- Gold price is under selling pressure for one more day and is approaching the critical 1,400 support. Stronger U.S. dollar helped by a better U.S. retail

Gold price is under selling pressure for one more day and is approaching the critical 1,400 support. Stronger U.S. dollar helped by a better U.S. retail sales data yesterday contributed to further pressure on Gold.

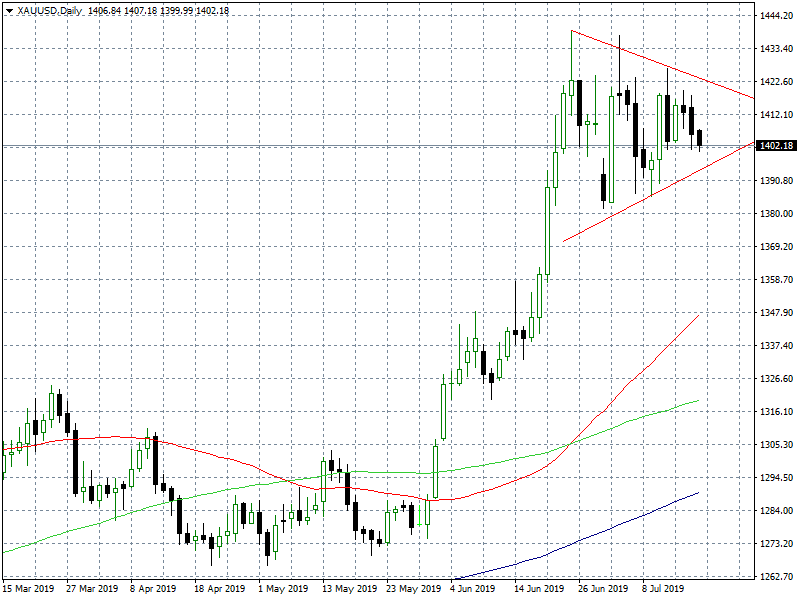

The low for the day is at 1,400 and the high at 1,407.18. The main trend is still bullish but the short term momentum shifted to the downside. In the mid-term, gold prices are trading sideways between $1381, and the year-to-date high at $1439.

Immediate support for the yellow metal stands at $1,386 the low from July 5th while traders that missed the recent rally waiting to enter long positions at 1,347 the 50 day moving average. On the upside resistance would be met at 1,407 the today’s high and the 200 hour moving average and then at 1,410 the 100 hour moving average before an attempt to 1,439 the high from June 26th.

Bulls are controlling the game as long as the price holds above 1,400. A break below will question the positive momentum, but I will wait for a break below 1,390 to start any short positions. The symmetrical triangle that had sketched is a continuation pattern meaning that gold is taking a short breath before it will continue higher. If the triangle support at 1,390 failed to stop the price then I will open a short position. A buy signal for me will occur If gold moves above 1,410 mark.

Traders must be cautious on gold at current level as the volatility is very high.Don’t miss a beat! Follow us on Twitter.