- Summary:

- Gold price had a difficult performance in May as the Federal Reserve embraced a highly hawkish tone. What next for the XAU/USD?

Gold price had a difficult performance in May as the Federal Reserve embraced a highly hawkish tone and as inflation remained at the highest level in more than 40 years. As a result, the XAU/USD pair crashed by more than 4% from its highest level during the month. At the current price, it is trading at the lowest level it has been since May 19th.

Gold is a leading precious metal whose price tends to depend on monetary policy instead of supply and demand dynamics. In May, the monetary policy sentiment around the world was significantly hawkish. For example, in the US, the Fed decided to hike interest rates by 0.50%, the highest increase in over 20 years. This increase followed the 0.25% hike that it implemented in March.

At the same time, officials warned that more 50 bps hikes were on the way. Christopher Waller argued that he would support measures to push rates above the neutral point by December this year. He pointed to the need to slow economic expansion and dramatically bring inflation down. Other central banks like the ECB and the Bank of England also remained hawkish in May.

Meanwhile, a new gold mining giant was formed in May as Yamana and Gold Fields decided to merge. Gold Fields will spend about $7 billion to buy Yamana, a Canadian company. The combined company will now become the fourth-biggest player in the industry. Analysts now expect that there will be more gold mining deals in the coming years.

Gold price prediction

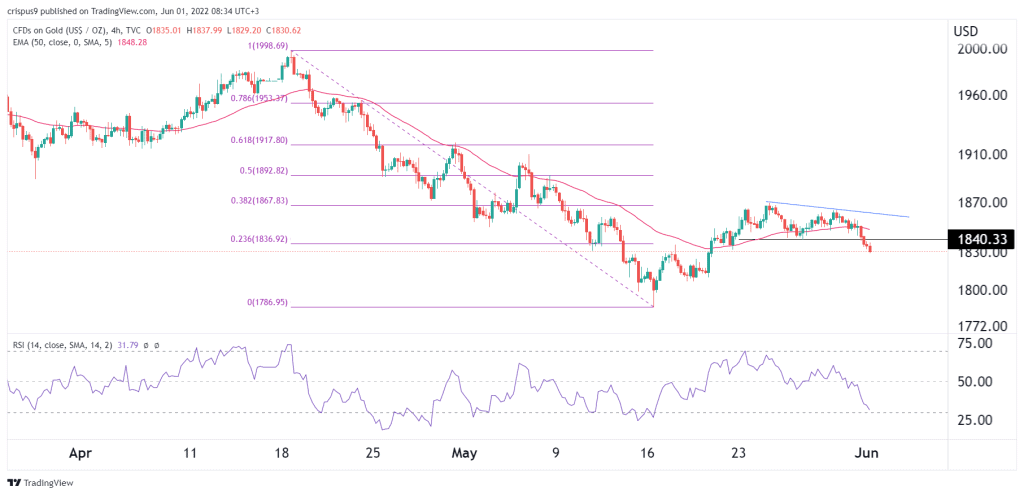

The four-hour chart shows that the XAU/USD pair has been in a strong sell-off in the past few days. As it dropped, the metal has managed to move below the important support level at $1,840, which was the lowest level on May 26th. It has moved below the 23.6% Fibonacci retracement level. The price is also below the 25-day and 50-day moving averages, while the Relative Strength Index (RSI) has moved close to the oversold level.

Therefore, gold price will likely continue falling in the first part of June as traders wait for the FOMC decision. If this happens, the next key support level to watch will be at $1,800. On the flip side, a move above the resistance at $1,850 will invalidate the bearish view.