- Expectation of a Fed rate hike is prompting a selloff. The gold price prediction indicates that a fall below $1900 is likely.

With less than 24 hours to the much-anticipated Fed rate decision, the gold price prediction is for a potential drop below $1900 if the Fed decides to deliver a 50bps rate hike instead of the widely expected 25bps pump.

This is a fascinating period for gold prices, as the impact of geopolitics and the expected central bank action from the US play contrasting roles in the pricing of the XAU/USD pair. Gold prices had recently climbed to their second-highest levels ever, hitting $2070.18 on 8 March as a flight to safety on account of the escalating Russia-Ukraine war sent institutional demand for the yellow metal soaring.

Comments by the US Treasury Secretary and former Fed chief Janet Yellen, who said that no currency could presently replace the greenback as the global reserve currency, triggered a cashout by some buyers. This has sent the XAU/USD down for the 3rd day in a row.

Gold prices are down 1.85% as of writing, ahead of the Fed decision. A 50bps rate hike will be USD-positive and drive more selling that could send the pair below the $1,900 mark. A 25bps rate hike will be less of a bullish trigger for the USD, as this expectation appears to have been priced in by the recent selloffs. Still, the comments by Fed Chair Jerome Powell could be a deciding factor on how much ground gold will have to sacrifice for the US Dollar.

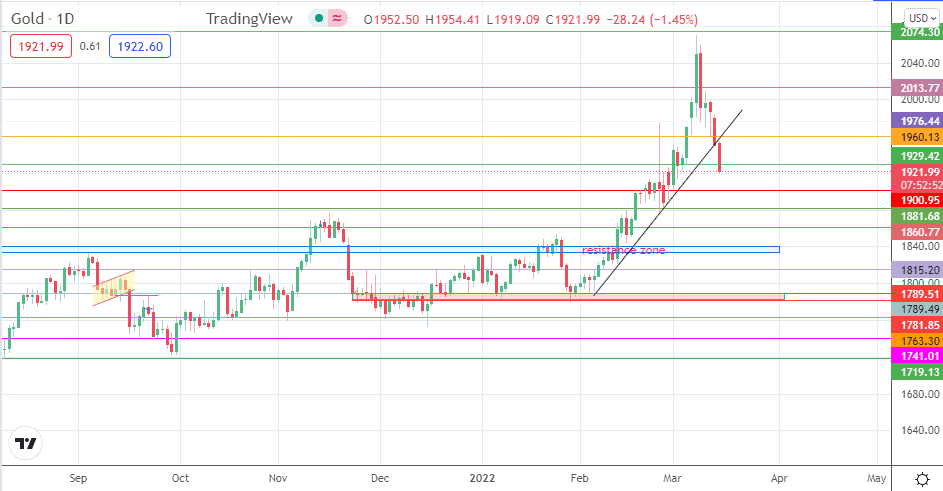

Gold Price Prediction

The breakdown of the 1929.42 support opens the door towards 1900. However, it would require the Fed to go beyond the market expectations to drive prices below 1900.95, leaving 1881.68 and 1860.77 as the immediate downside targets. On the other hand, a bounce on the 1900.95 allows for a retest of 1929.42. If the bulls uncap this resistance, 1960.13 and 1976.44 will enter the mix as additional targets to the north.

XAU/USD: Daily Chart

Follow Eno on Twitter.