- Summary:

- Hawkish Fedspeak is putting pressure on the XAU/USD pair ahead of the FOMC minutes, generating negative gold price predictions.

Gold price predictions remain tilted to the bearish end of the spectrum as the price action continues to consolidate between 1877 above and 1800 below. On the day, the gold price on the XAU/USD chart is down 0.13% as the market prepares for the release of the FOMC minutes on Wednesday and Friday’s delayed Non-farm Payrolls report.

Gold price dropped from the top end of the range following recent hawkish Fedspeak. All across the world, central banks are now using rate hikes to combat global inflation. The Fed releases its next interest rate numbers on 27 July, with a noted FOMC member calling for another 75 basis points rate hike. Rate expectations rather than current inflation data appear to be the dominant factor dictating gold price predictions. The FOMC minutes will indicate the mindset of the US apex bank heading into its decision in late July.

The XAU/USD comes into focus on Friday as the US reports the Non-farm Payrolls data. Delayed by a week because of the US Independence weekend holiday, the market expects a lower addition to jobs and a static unemployment rate. A print that surprises the upside in the face of stagnant or lower unemployment rates could put gold prices on the back foot.

Gold Price Prediction

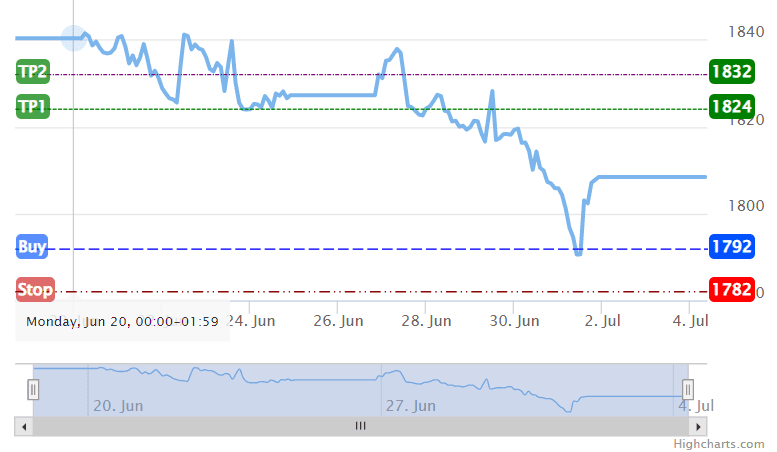

According to the trade idea by the Investingcube S-R indicator, the pair remains bullish. However, the trade entry at the 1792 price mark (28 December 2021 and 4 February 2022 lows) would require a retracement below the 1800 psychological support. The dip toward the 1 July low and subsequent bounce also reinforced this price level as valid support. The bull’s initial target rests at 1824, which is close to the 11 January, 7 February and 30 June 2022 highs. Above this level, an additional harvest point comes in at 1832 (3 January and 29 June highs). Other resistance targets are formed by the 1850 price mark (26 January high) and the 1877 barrier (13 June high).

On the flip side, a decline below 1792 focuses on 1762 as the immediate downside target for contrarian traders. If 1762 gives way due to unopposed bearish action, 1750 (11 October 2021 low) and 1721 (5 April 2021 and 29 September 2021 lows) become additional harvest points for the bears. By this time, the long trade’s stop would have been triggered.

Gold Price Chart